Grow premium, not headcount

Grow premium,

not headcount

Win more of the right business with AI-powered submission and triage

Create an inbox for submissions within my current risk appetite…

Faster responses

Quote in minutes, outpace the competition and win more busienss

Faster responses

Quote in minutes, outpace the competition and win more busienss

Faster responses

Quote in minutes, outpace the competition and win more busienss

Less manual busywork

Free your underwriting experts to focus on judgements calls

Less manual busywork

Free your underwriting experts to focus on judgements calls

Less manual busywork

Free your underwriting experts to focus on judgements calls

Smarter triage decisions

Target the right risks with triage guided by your models and strategy

Smarter triage decisions

Target the right risks with triage guided by your models and strategy

Smarter triage decisions

Target the right risks with triage guided by your models and strategy

The fastest path from

submission to quote

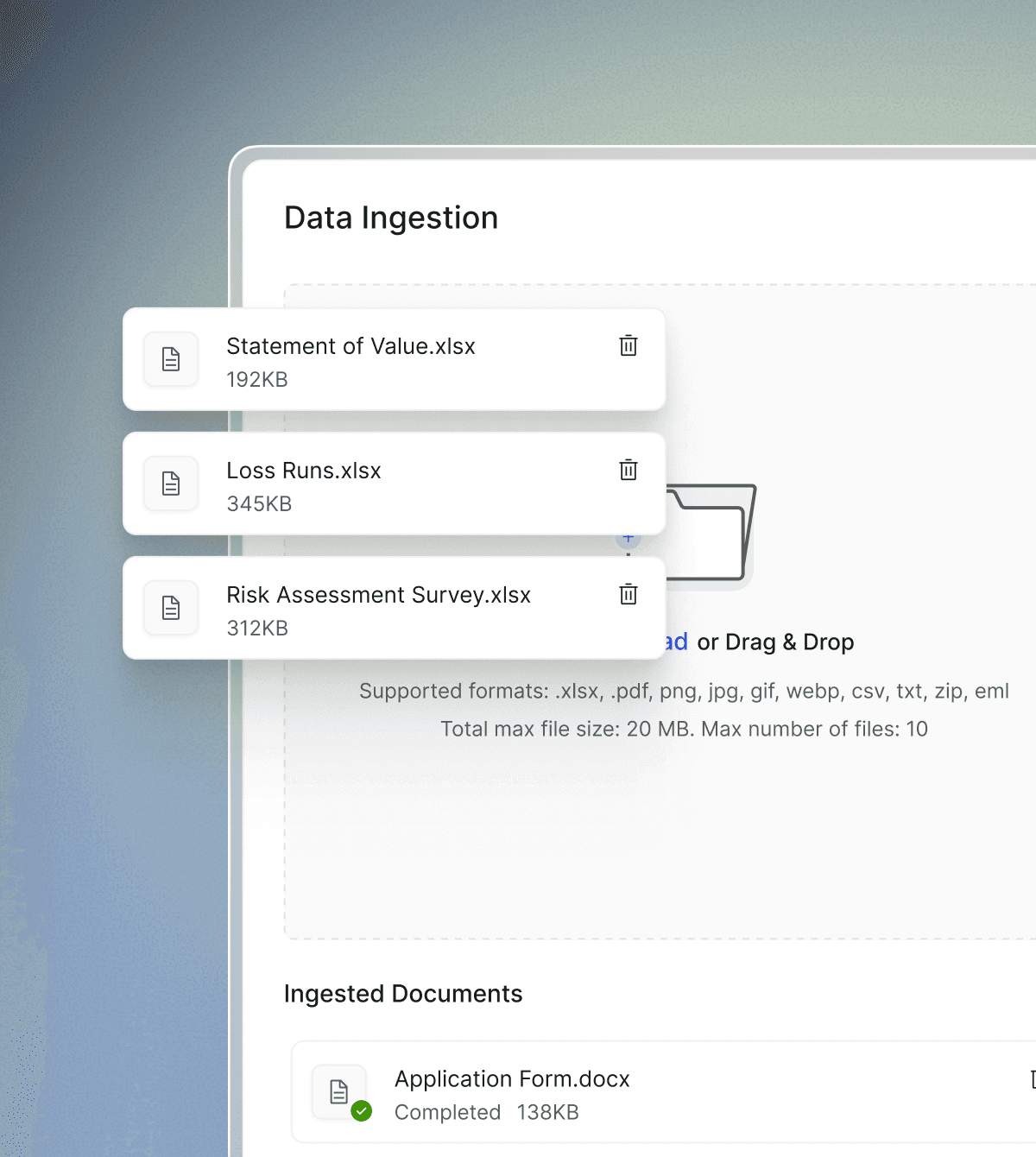

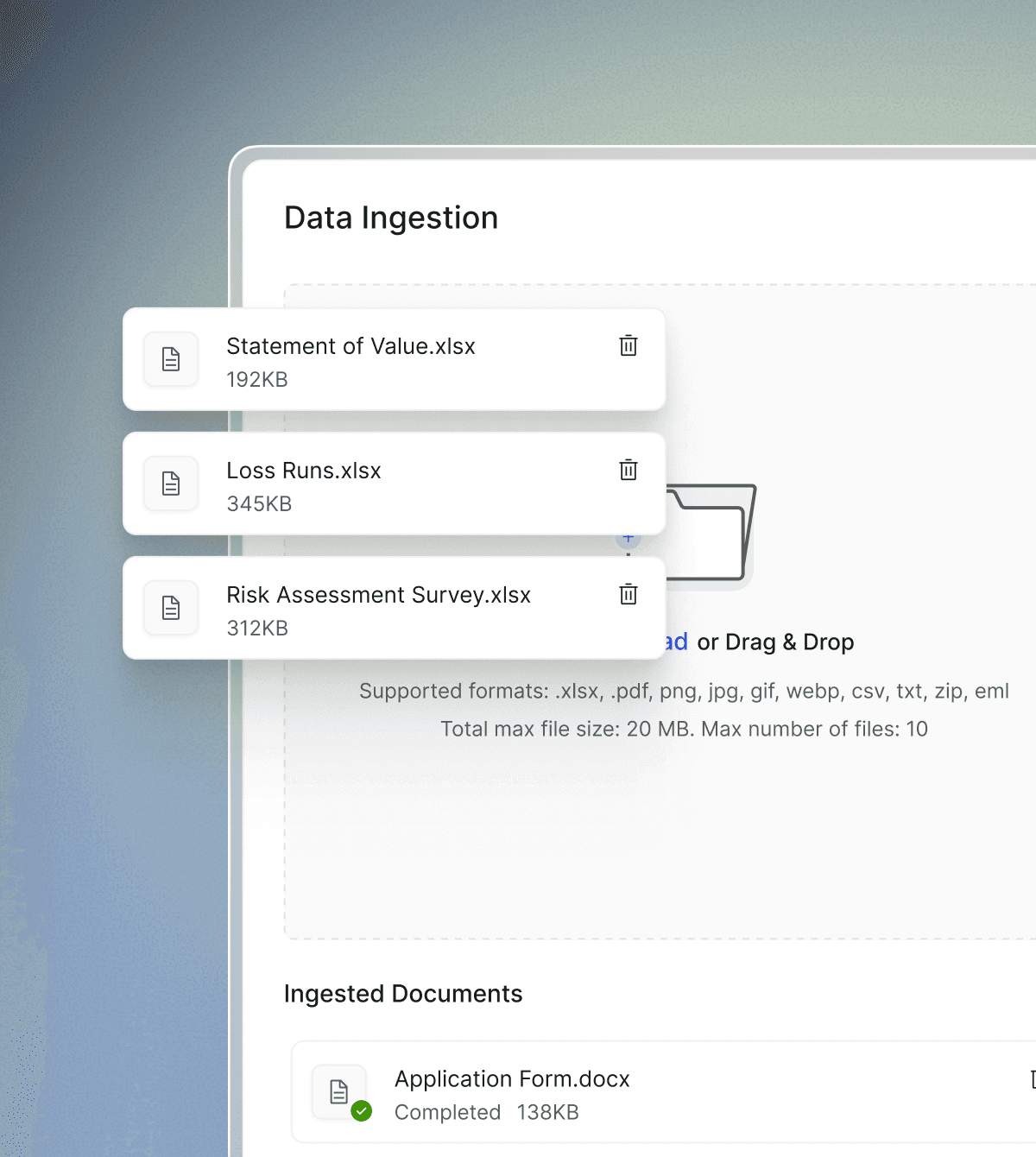

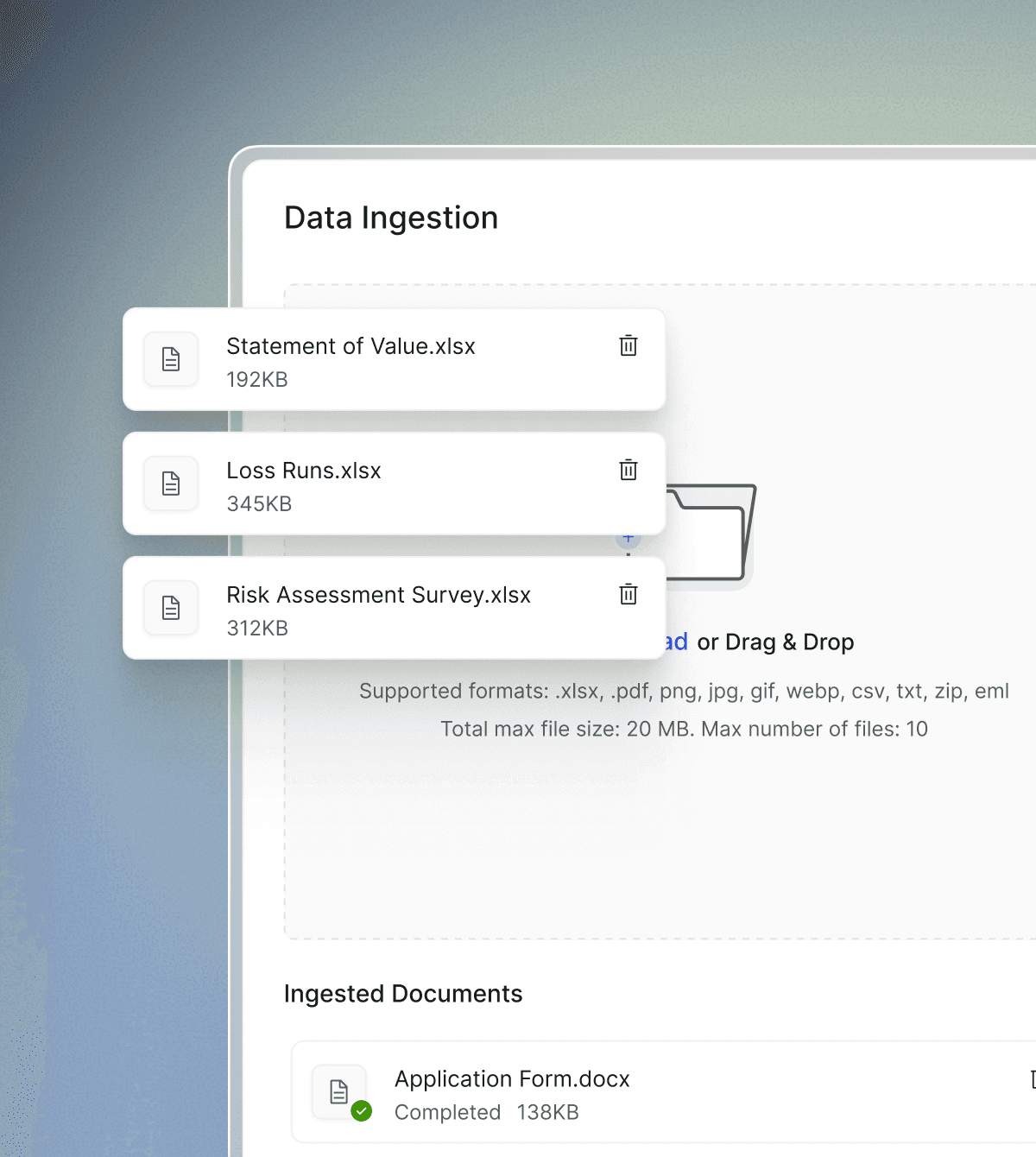

AI-powered submission intake

Automatically ingest submissions from Excel, PDF, Word, email, and image sources, converting unstructured data into structured fields ready for triage.

Reduce manual rekeying and errors at the first touchpoint so underwriters start with complete, reliable information and can move faster from intake to decision.

AI-powered submission intake

Automatically ingest submissions from Excel, PDF, Word, email, and image sources, converting unstructured data into structured fields ready for triage.

Reduce manual rekeying and errors at the first touchpoint so underwriters start with complete, reliable information and can move faster from intake to decision.

AI-powered submission intake

Automatically ingest submissions from Excel, PDF, Word, email, and image sources, converting unstructured data into structured fields ready for triage.

Reduce manual rekeying and errors at the first touchpoint so underwriters start with complete, reliable information and can move faster from intake to decision.

Triage and risk appetite models

Codify risk appetite rules and underwriting guidelines into configurable models that are easy to maintain as strategy evolves.

Deploy prioritisation logic of any complexity to consistently route and rank submissions by fit and profitability, ensuring underwriters spend time where it creates the greatest commercial impact.

Triage and risk appetite models

Codify risk appetite rules and underwriting guidelines into configurable models that are easy to maintain as strategy evolves.

Deploy prioritisation logic of any complexity to consistently route and rank submissions by fit and profitability, ensuring underwriters spend time where it creates the greatest commercial impact.

Triage and risk appetite models

Codify risk appetite rules and underwriting guidelines into configurable models that are easy to maintain as strategy evolves.

Deploy prioritisation logic of any complexity to consistently route and rank submissions by fit and profitability, ensuring underwriters spend time where it creates the greatest commercial impact.

Indicative pricing

Provide indicative pricing directly in the underwriter’s initial submission view to support early selection and steering decisions.

When a risk meets appetite, underwriters can progress into full pricing and deeper analysis in a single click, maintaining momentum from triage through to quote.

Indicative pricing

Provide indicative pricing directly in the underwriter’s initial submission view to support early selection and steering decisions.

When a risk meets appetite, underwriters can progress into full pricing and deeper analysis in a single click, maintaining momentum from triage through to quote.

Indicative pricing

Provide indicative pricing directly in the underwriter’s initial submission view to support early selection and steering decisions.

When a risk meets appetite, underwriters can progress into full pricing and deeper analysis in a single click, maintaining momentum from triage through to quote.

Underwriter dashboard

Surface submissions in a dedicated underwriter dashboard with the key attributes, triage outcomes, and supporting details visible upfront.

Enable quick, confident decisions by reducing document switching and ensuring the most relevant risks and next actions are immediately clear.

Underwriter dashboard

Surface submissions in a dedicated underwriter dashboard with the key attributes, triage outcomes, and supporting details visible upfront.

Enable quick, confident decisions by reducing document switching and ensuring the most relevant risks and next actions are immediately clear.

Underwriter dashboard

Surface submissions in a dedicated underwriter dashboard with the key attributes, triage outcomes, and supporting details visible upfront.

Enable quick, confident decisions by reducing document switching and ensuring the most relevant risks and next actions are immediately clear.

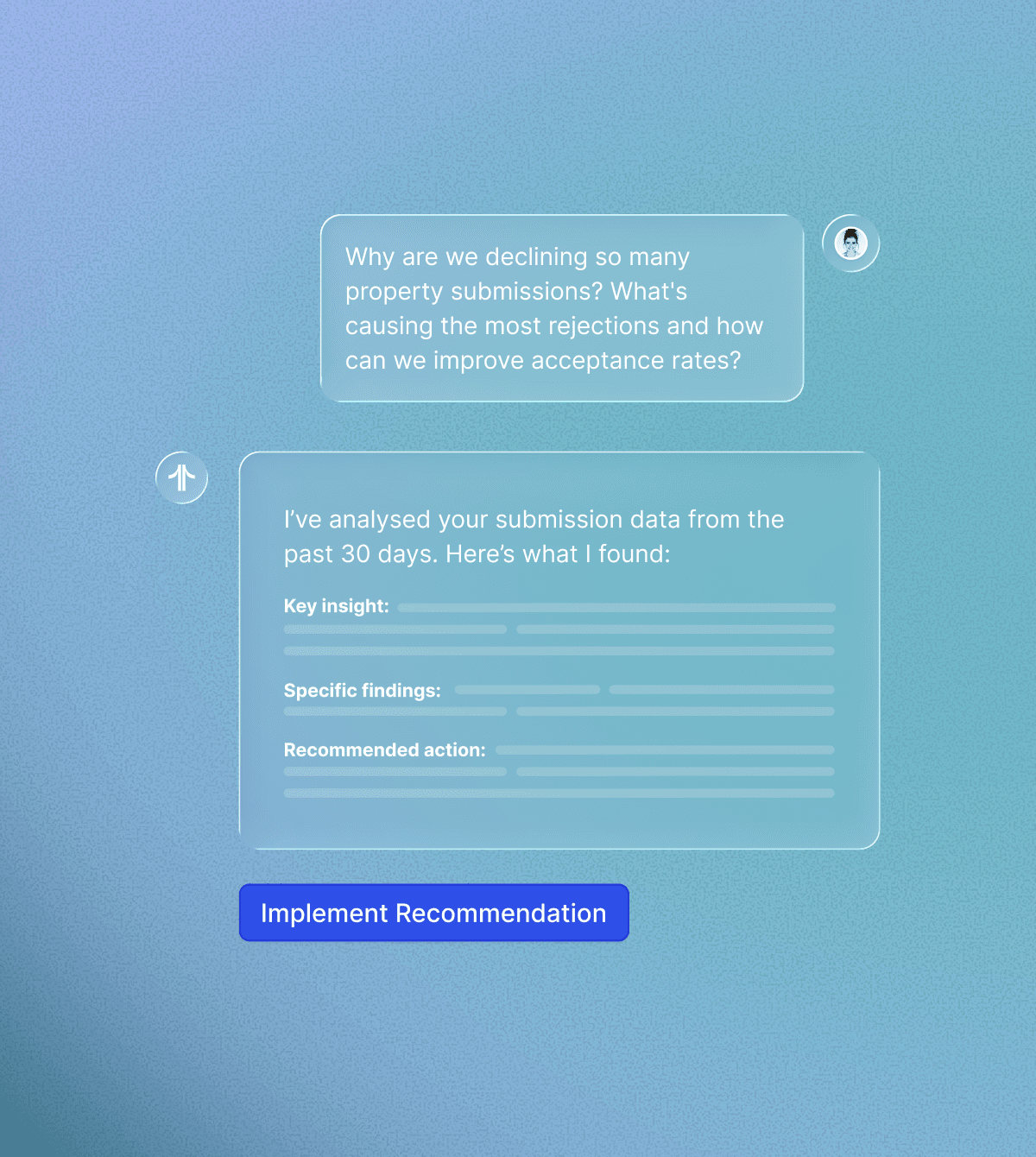

Submission-to-quote insights

Capture data across every submission and track progress through quote and bind to create a complete, auditable view of underwriting performance.

Measure submission-to-quote and submission-to-bind ratios by segment, broker, and channel to identify where process improvements or appetite shifts can unlock additional profitable growth.

Submission-to-quote insights

Capture data across every submission and track progress through quote and bind to create a complete, auditable view of underwriting performance.

Measure submission-to-quote and submission-to-bind ratios by segment, broker, and channel to identify where process improvements or appetite shifts can unlock additional profitable growth.

Submission-to-quote insights

Capture data across every submission and track progress through quote and bind to create a complete, auditable view of underwriting performance.

Measure submission-to-quote and submission-to-bind ratios by segment, broker, and channel to identify where process improvements or appetite shifts can unlock additional profitable growth.

Risk appetite optimization

Run scenario analysis on alternative appetite structures to understand the expected effect on volume, mix, and profitability before making changes.

Support strategic decisions about where to tighten or loosen appetite with clear projections, so growth initiatives are deliberate, measurable, and aligned with underwriting goals.

Risk appetite optimization

Run scenario analysis on alternative appetite structures to understand the expected effect on volume, mix, and profitability before making changes.

Support strategic decisions about where to tighten or loosen appetite with clear projections, so growth initiatives are deliberate, measurable, and aligned with underwriting goals.

Risk appetite optimization

Run scenario analysis on alternative appetite structures to understand the expected effect on volume, mix, and profitability before making changes.

Support strategic decisions about where to tighten or loosen appetite with clear projections, so growth initiatives are deliberate, measurable, and aligned with underwriting goals.

Enterprise grade security

and compliance

Enterprise Security

SOC Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Enterprise Security

SOC Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Enterprise Security

SOC Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

"By partnering with hx, we're making intelligent underwriting a reality for our Global Corporate & Specialty business"

Karen Dayal

Chief Underwriting Officer, Aviva

"By partnering with hx, we're making intelligent underwriting a reality for our Global Corporate & Specialty business"

Karen Dayal

Chief Underwriting Officer, Aviva

"By partnering with hx, we're making intelligent underwriting a reality for our Global Corporate & Specialty business"

Karen Dayal

Chief Underwriting Officer, Aviva

FAQs

01

How complex is the integration and set-up?

hx's API-first, composable architecture enables phased deployment alongside existing systems. Start with Submission Ingestion & Triage or Pricing & Rating, then expand—no rip-and-replace required. Carriers using this approach have achieved 40% faster cycle times while reducing IT integration costs.

02

Is the triage system a black box?

hx's API-first, composable architecture enables phased deployment alongside existing systems. Start with Submission Ingestion & Triage or Pricing & Rating, then expand—no rip-and-replace required. Carriers using this approach have achieved 40% faster cycle times while reducing IT integration costs.

03

What submission formats do you support?

hx's API-first, composable architecture enables phased deployment alongside existing systems. Start with Submission Ingestion & Triage or Pricing & Rating, then expand—no rip-and-replace required. Carriers using this approach have achieved 40% faster cycle times while reducing IT integration costs.

04

What are the main differences between hx's Submission and Triage solution and other similar tools?

hx's API-first, composable architecture enables phased deployment alongside existing systems. Start with Submission Ingestion & Triage or Pricing & Rating, then expand—no rip-and-replace required. Carriers using this approach have achieved 40% faster cycle times while reducing IT integration costs.

FAQs

01

How complex is the integration and set-up?

hx's API-first, composable architecture enables phased deployment alongside existing systems. Start with Submission Ingestion & Triage or Pricing & Rating, then expand—no rip-and-replace required. Carriers using this approach have achieved 40% faster cycle times while reducing IT integration costs.

02

Is the triage system a black box?

hx's API-first, composable architecture enables phased deployment alongside existing systems. Start with Submission Ingestion & Triage or Pricing & Rating, then expand—no rip-and-replace required. Carriers using this approach have achieved 40% faster cycle times while reducing IT integration costs.

03

What submission formats do you support?

hx's API-first, composable architecture enables phased deployment alongside existing systems. Start with Submission Ingestion & Triage or Pricing & Rating, then expand—no rip-and-replace required. Carriers using this approach have achieved 40% faster cycle times while reducing IT integration costs.

04

What are the main differences between hx's Submission and Triage solution and other similar tools?

hx's API-first, composable architecture enables phased deployment alongside existing systems. Start with Submission Ingestion & Triage or Pricing & Rating, then expand—no rip-and-replace required. Carriers using this approach have achieved 40% faster cycle times while reducing IT integration costs.

Accelerate your journey

from submission to decision

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018