Optimize portfolio profitability

Get answers and take action in real-time

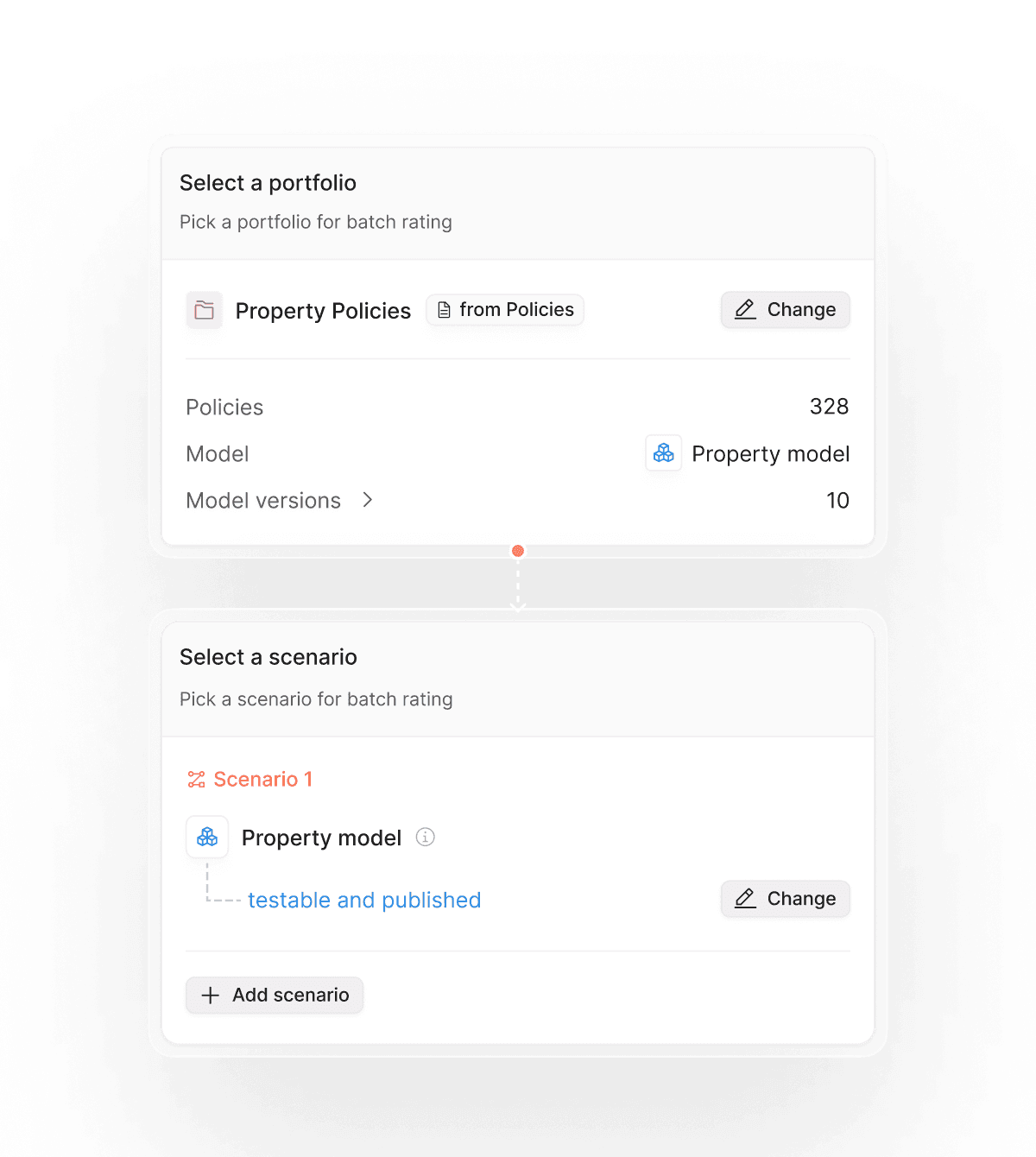

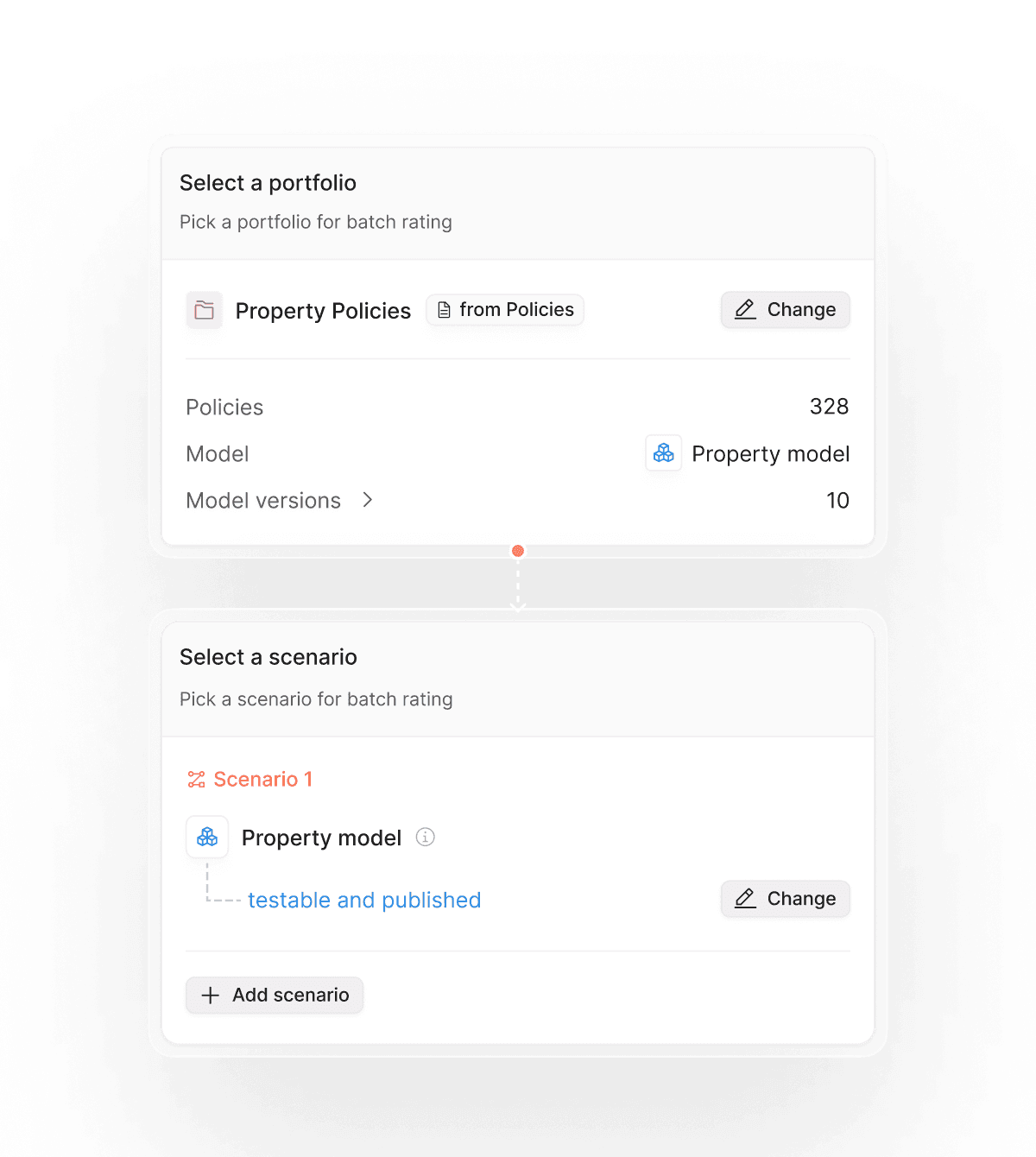

Create a new batch run on historic property policies…

Create a new batch run on historic property policies…

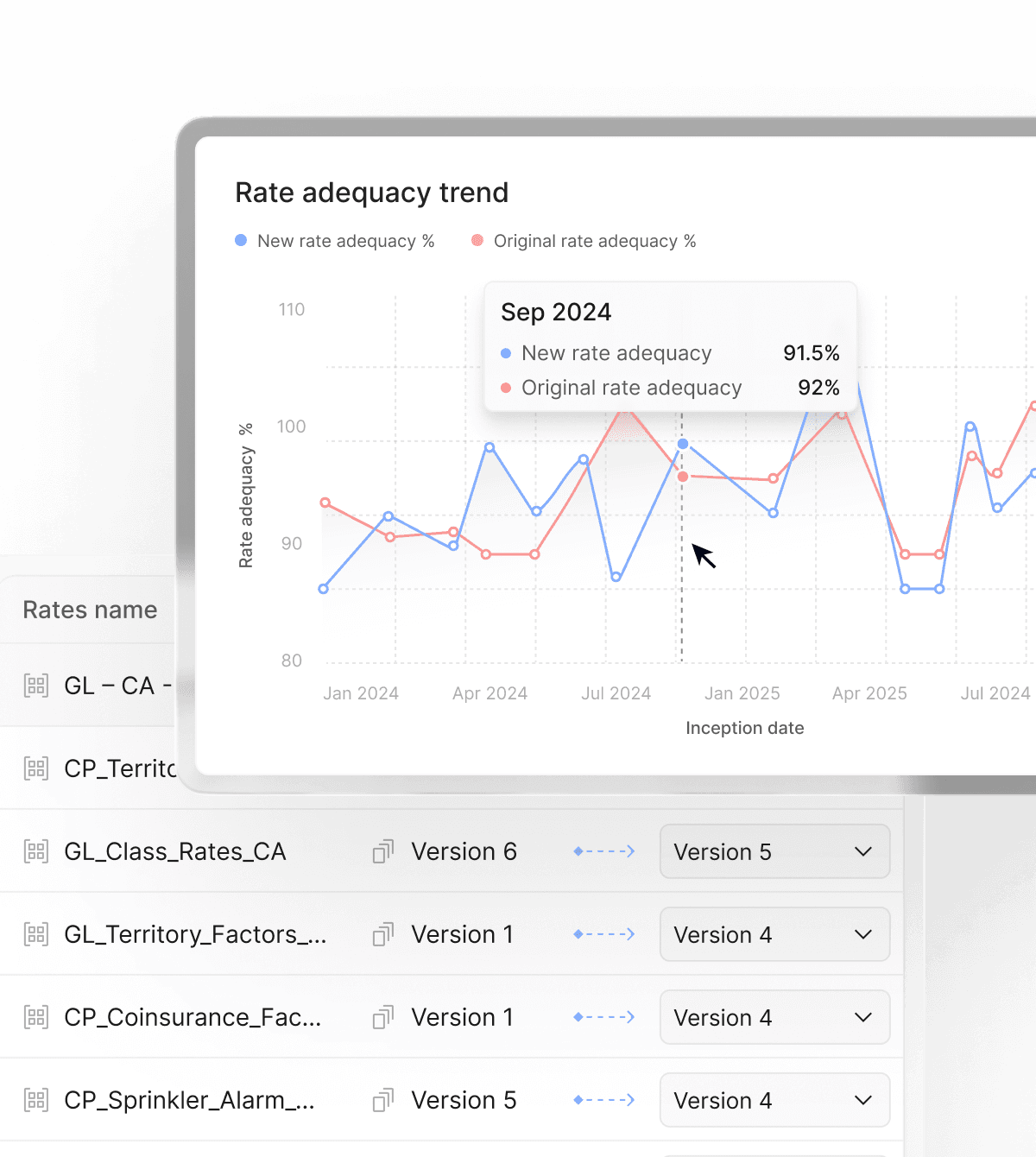

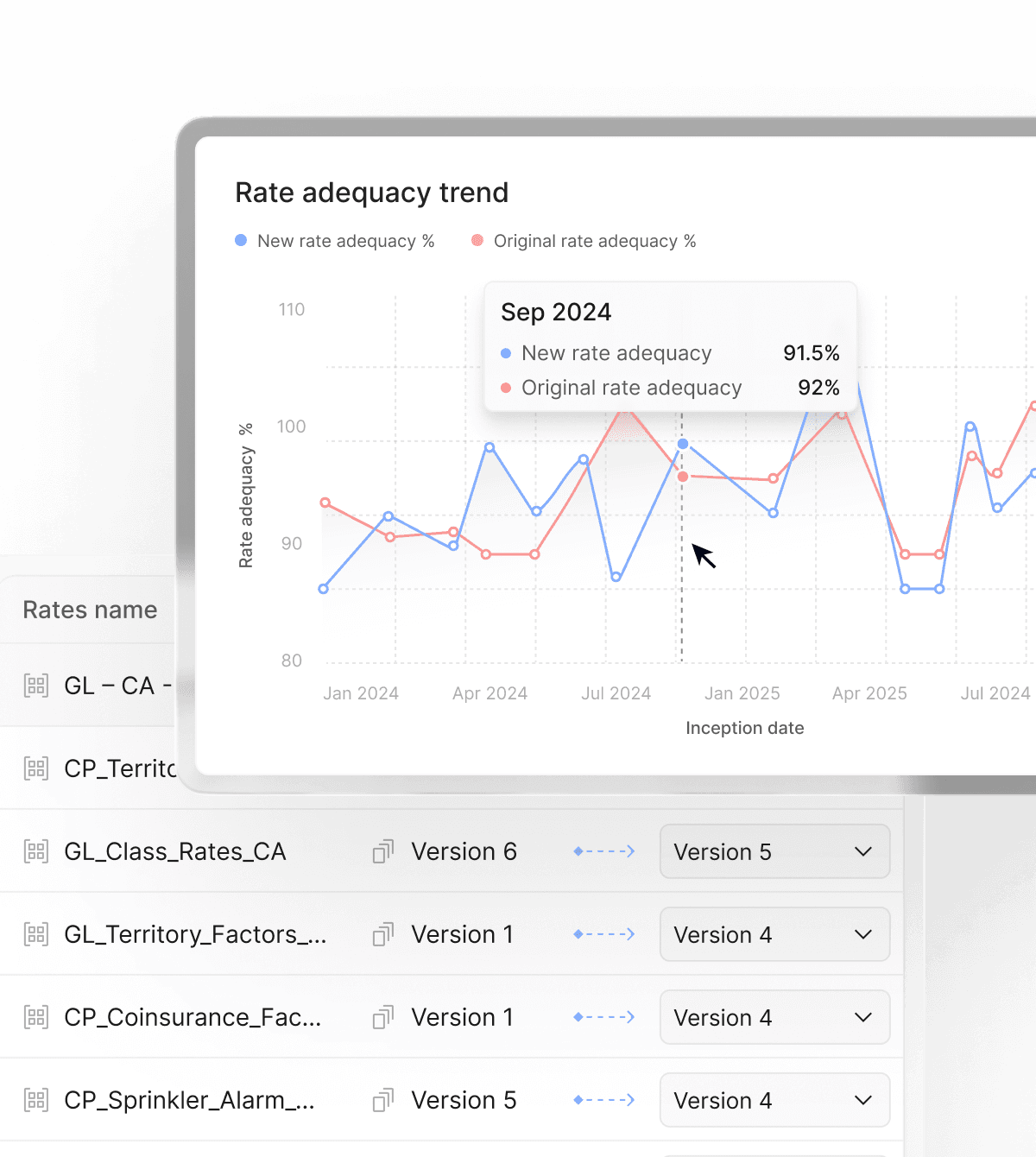

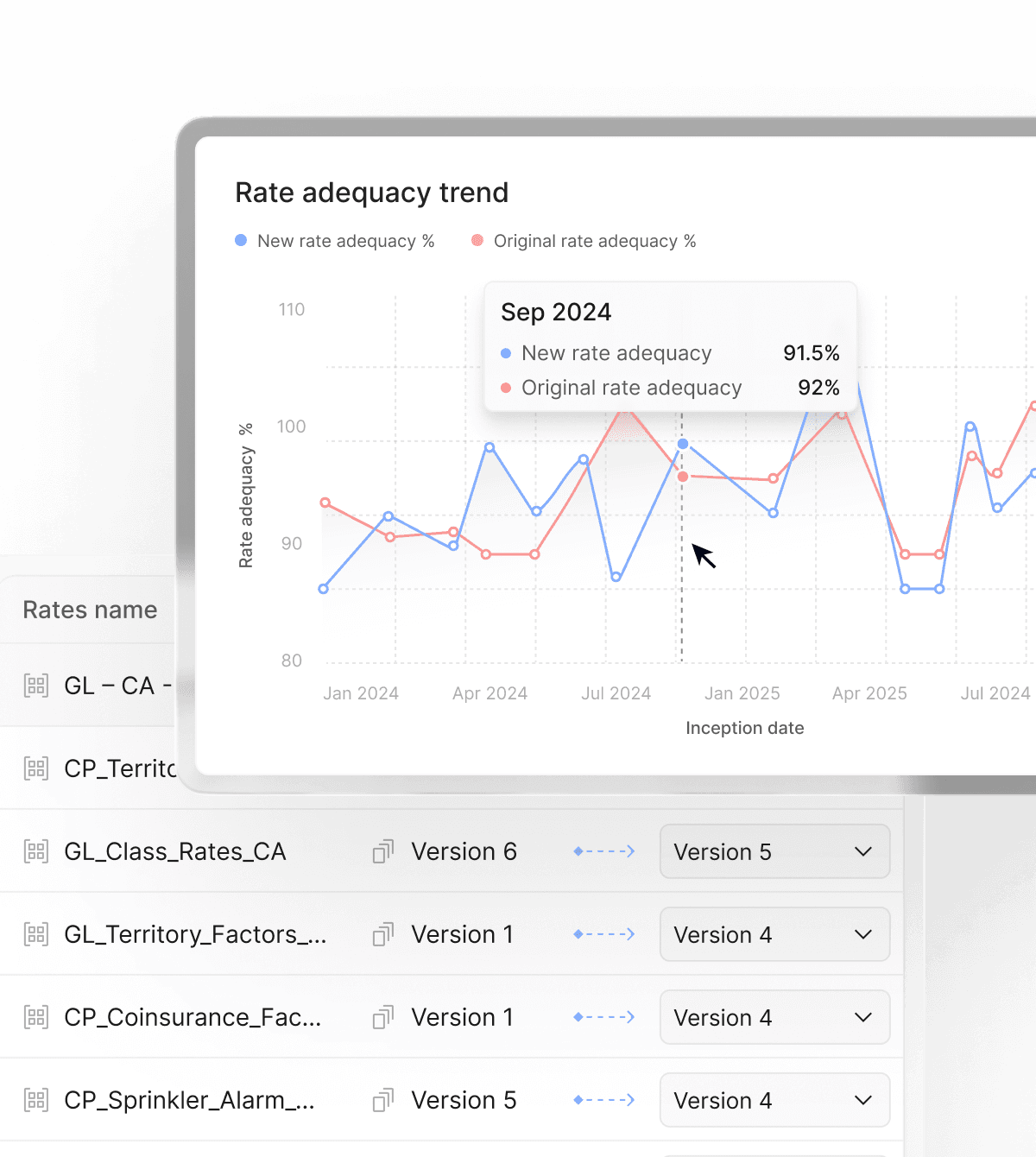

Real-time visibility

Track portfolio performance and rate change in real time

Real-time visibility

Track portfolio performance and rate change in real time

Real-time visibility

Track portfolio performance and rate change in real time

Faster experimentation

Test strategies faster with one-click what-if scenarios

Faster experimentation

Test strategies faster with one-click what-if scenarios

Faster experimentation

Test strategies faster with one-click what-if scenarios

Continuous optimization

Improve loss ratios with continuous real-time model updates

Continuous optimization

Improve loss ratios with continuous real-time model updates

Continuous optimization

Improve loss ratios with continuous real-time model updates

Bring control and clarity

to pricing strategy

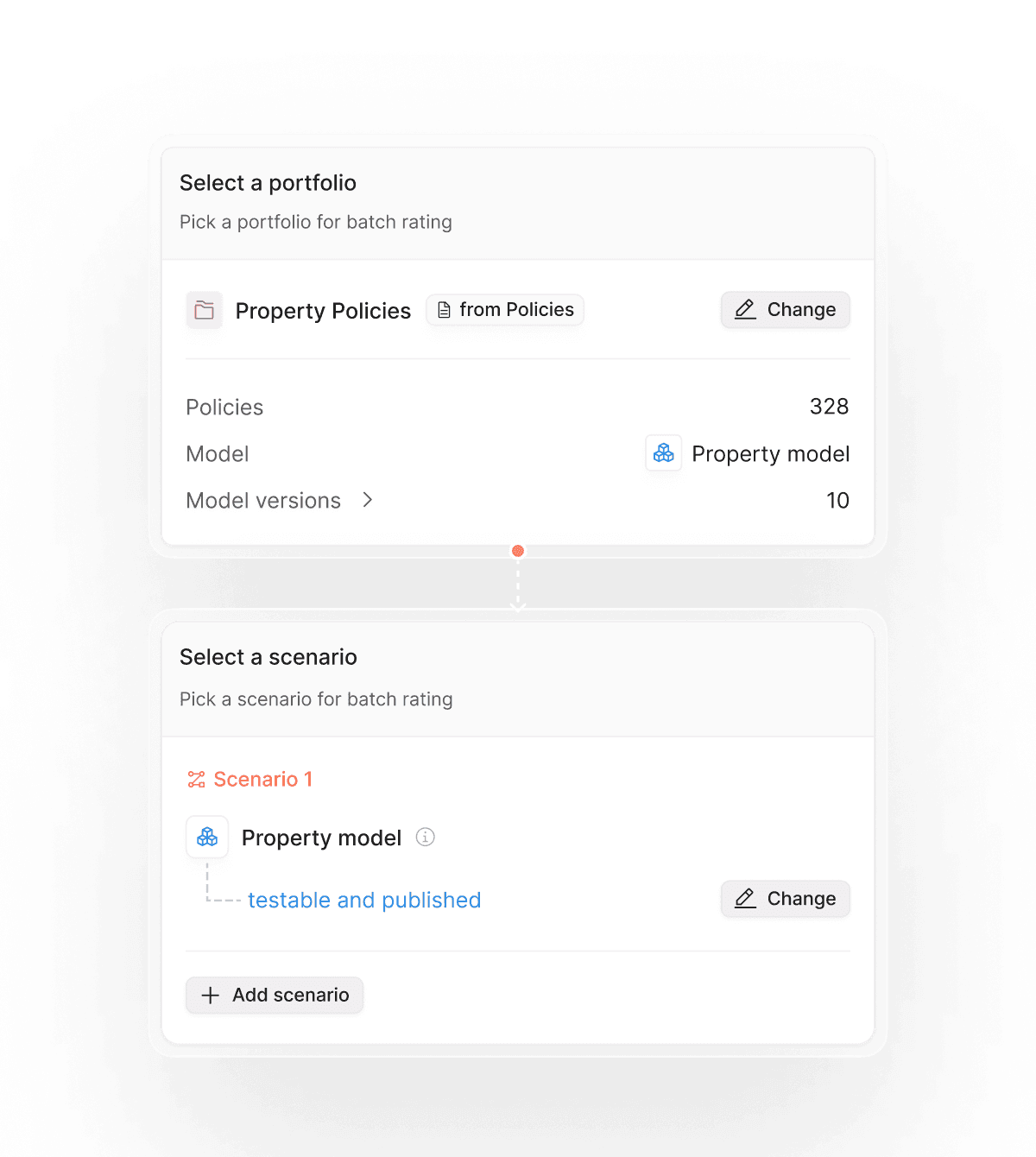

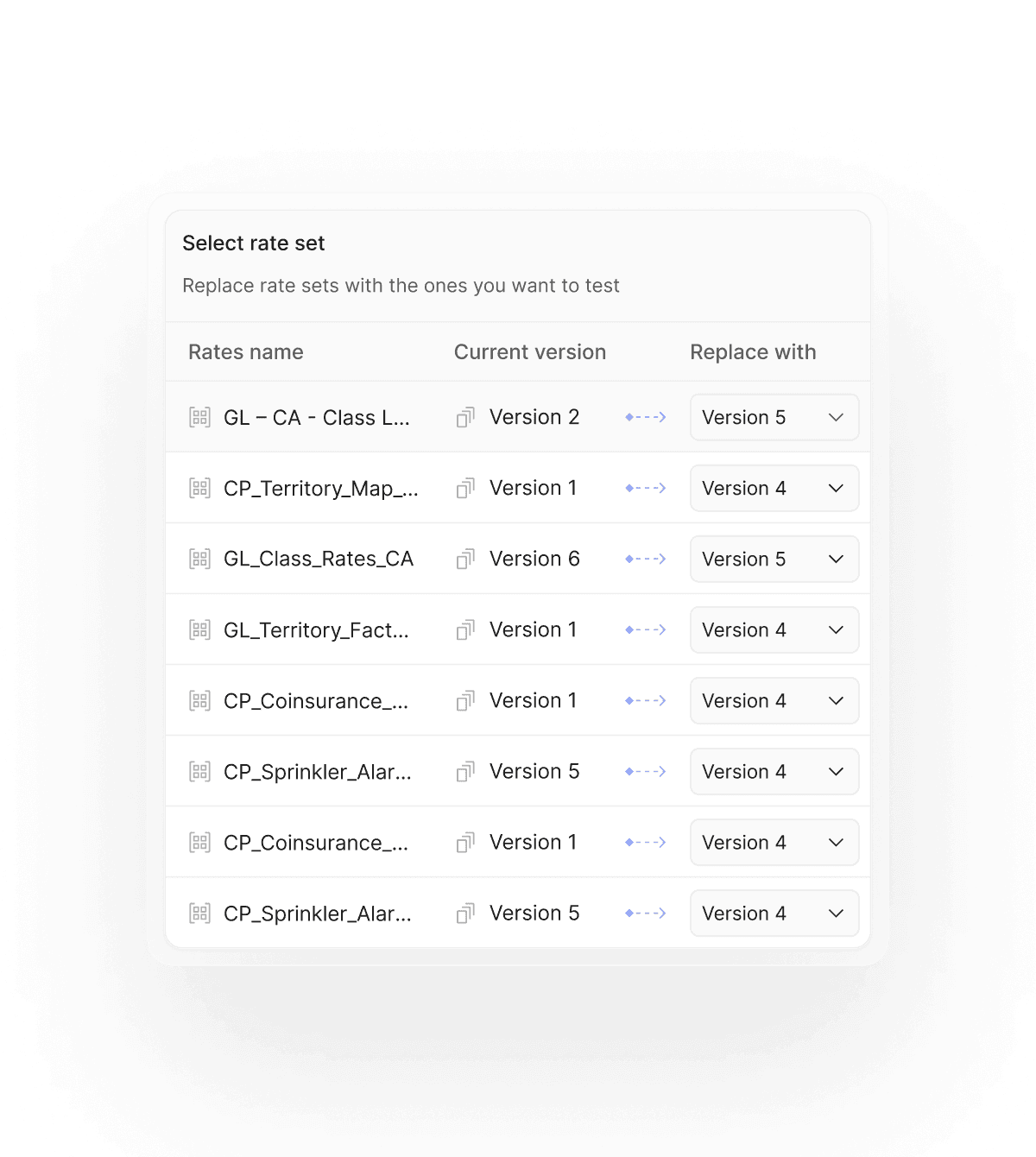

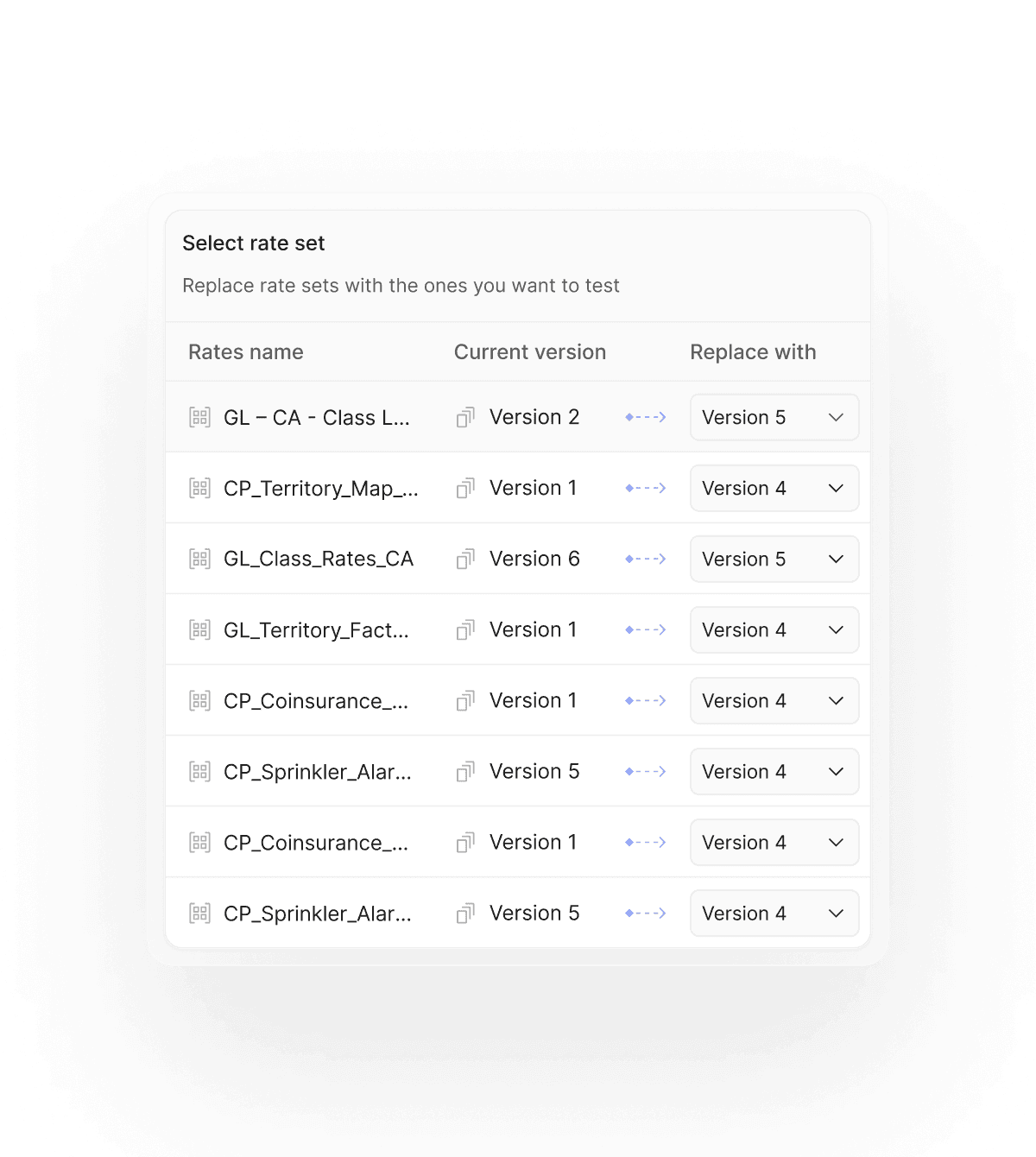

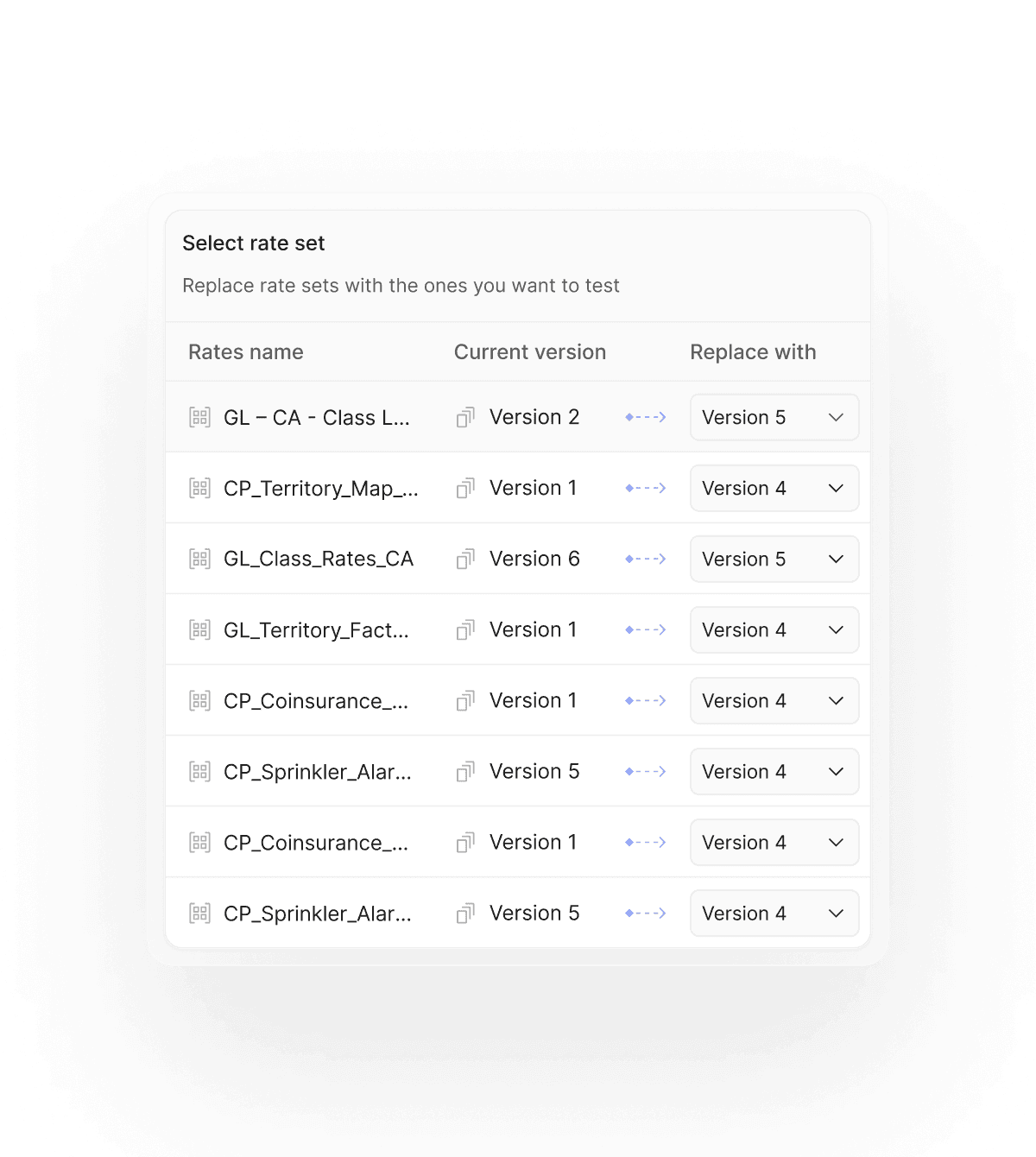

Batch rating

Re-run historic portfolios on new models and proposed rates in a single click to support testing, analysis, and deployment.

Quickly quantify impact at scale so actuarial and underwriting teams can validate changes before they go live.

Batch rating

Re-run historic portfolios on new models and proposed rates in a single click to support testing, analysis, and deployment.

Quickly quantify impact at scale so actuarial and underwriting teams can validate changes before they go live.

Batch rating

Re-run historic portfolios on new models and proposed rates in a single click to support testing, analysis, and deployment.

Quickly quantify impact at scale so actuarial and underwriting teams can validate changes before they go live.

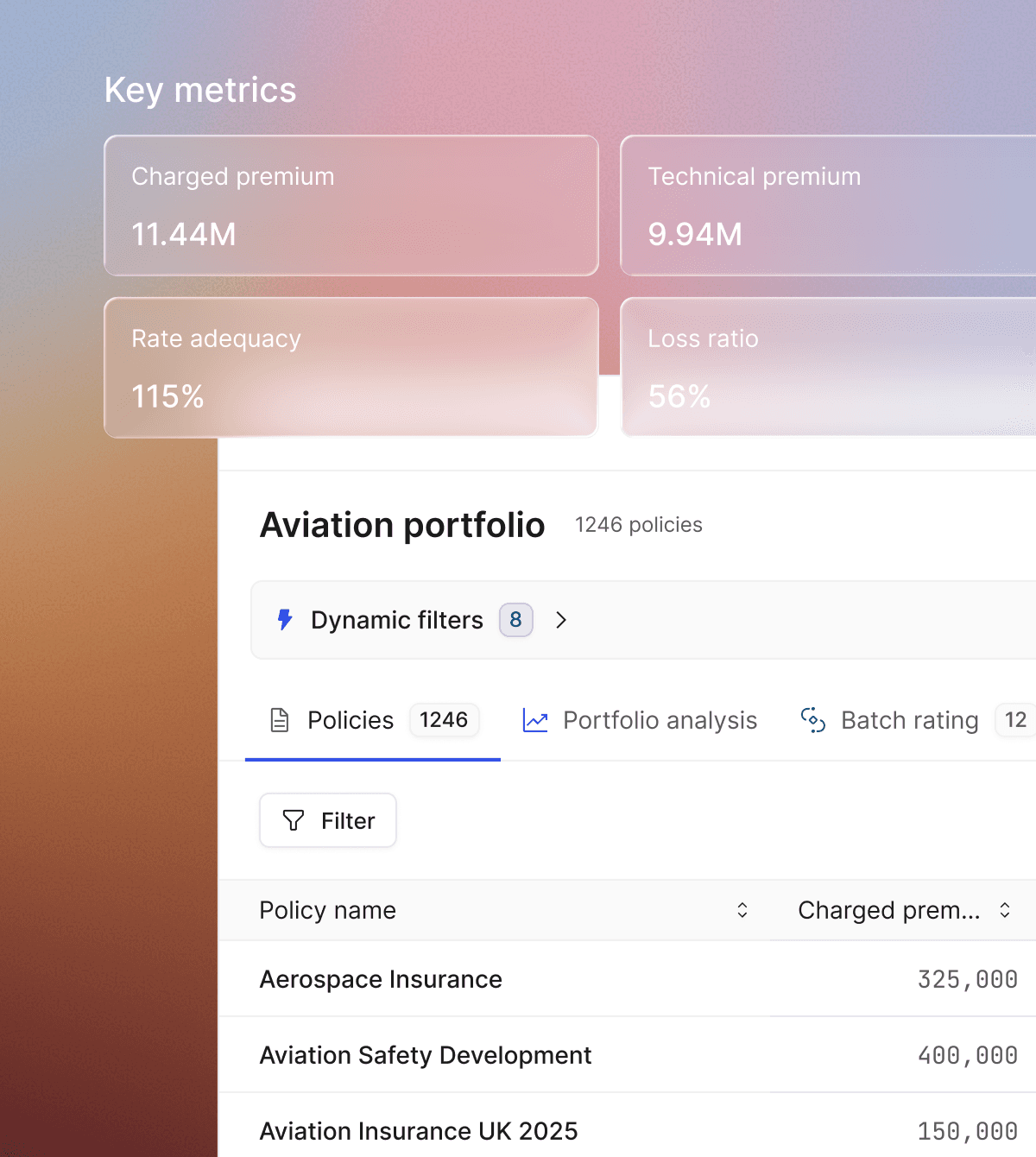

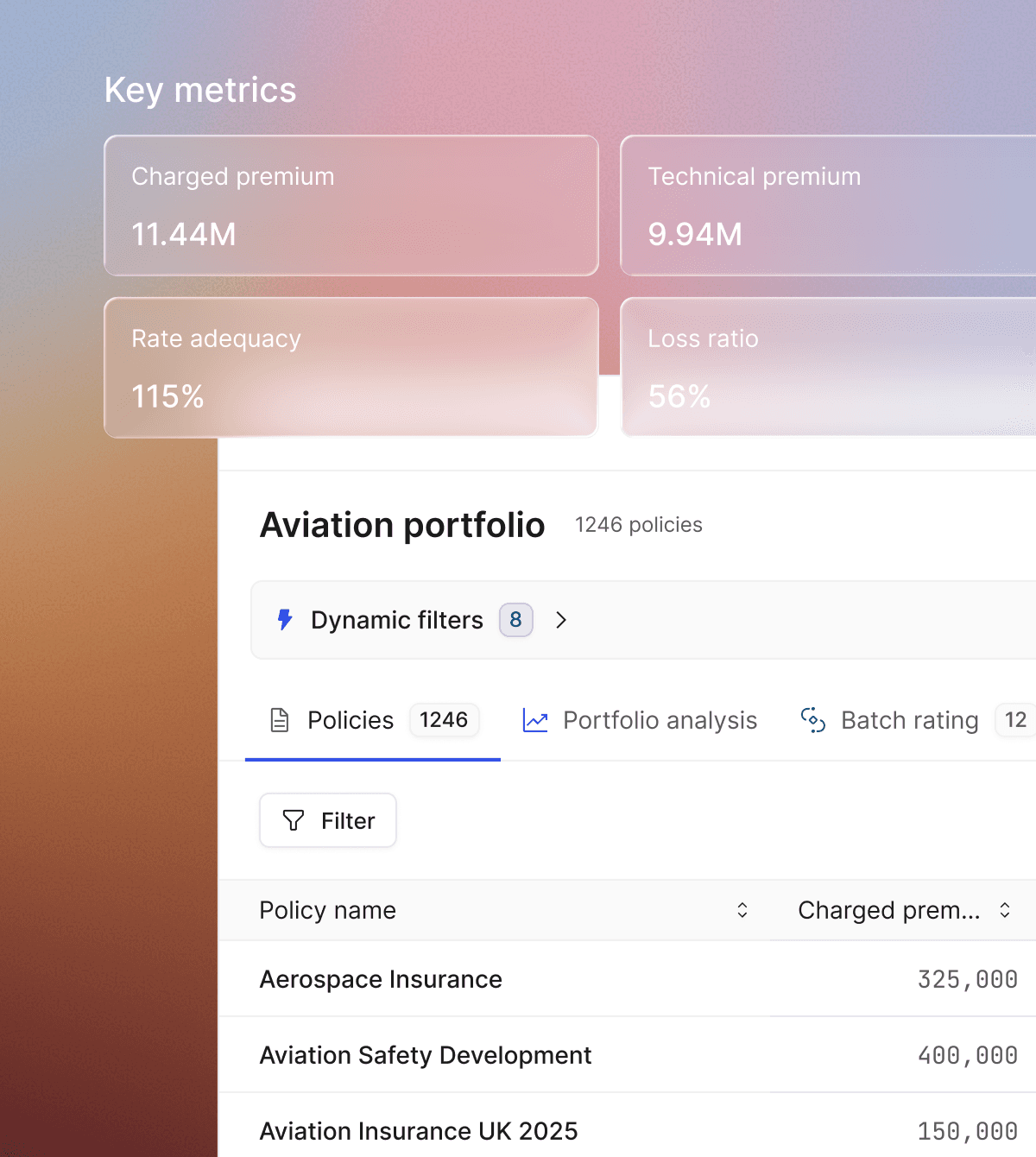

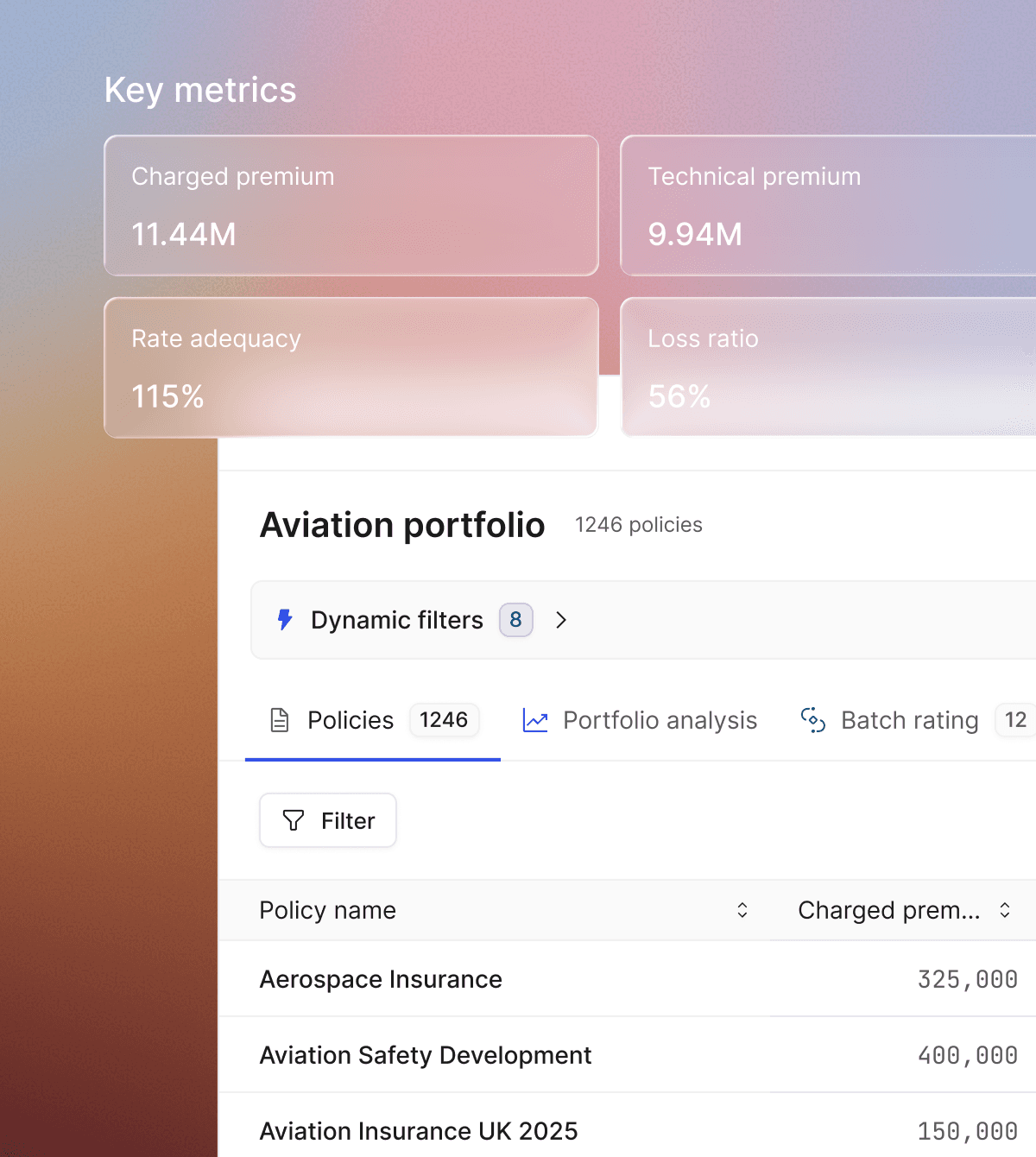

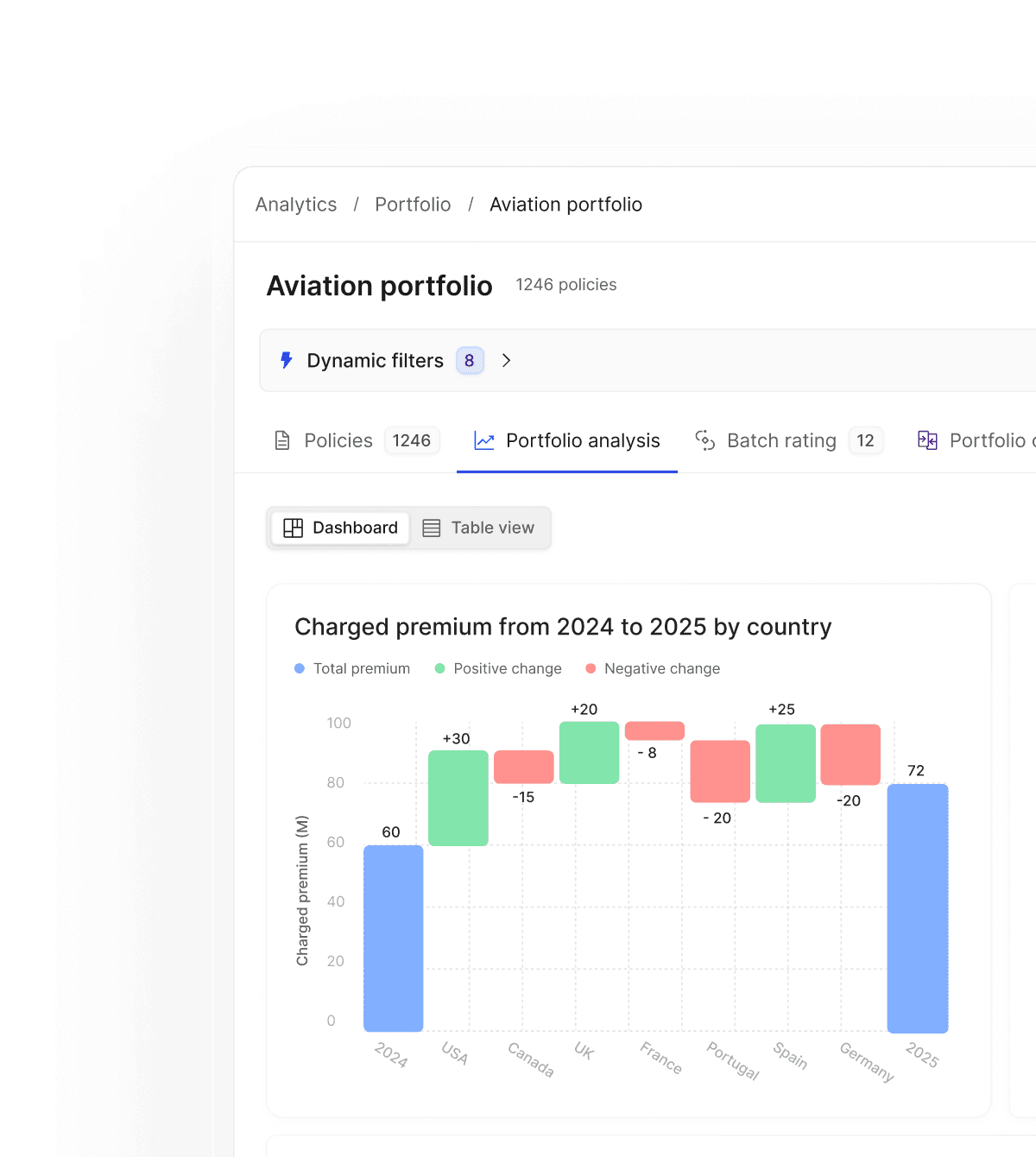

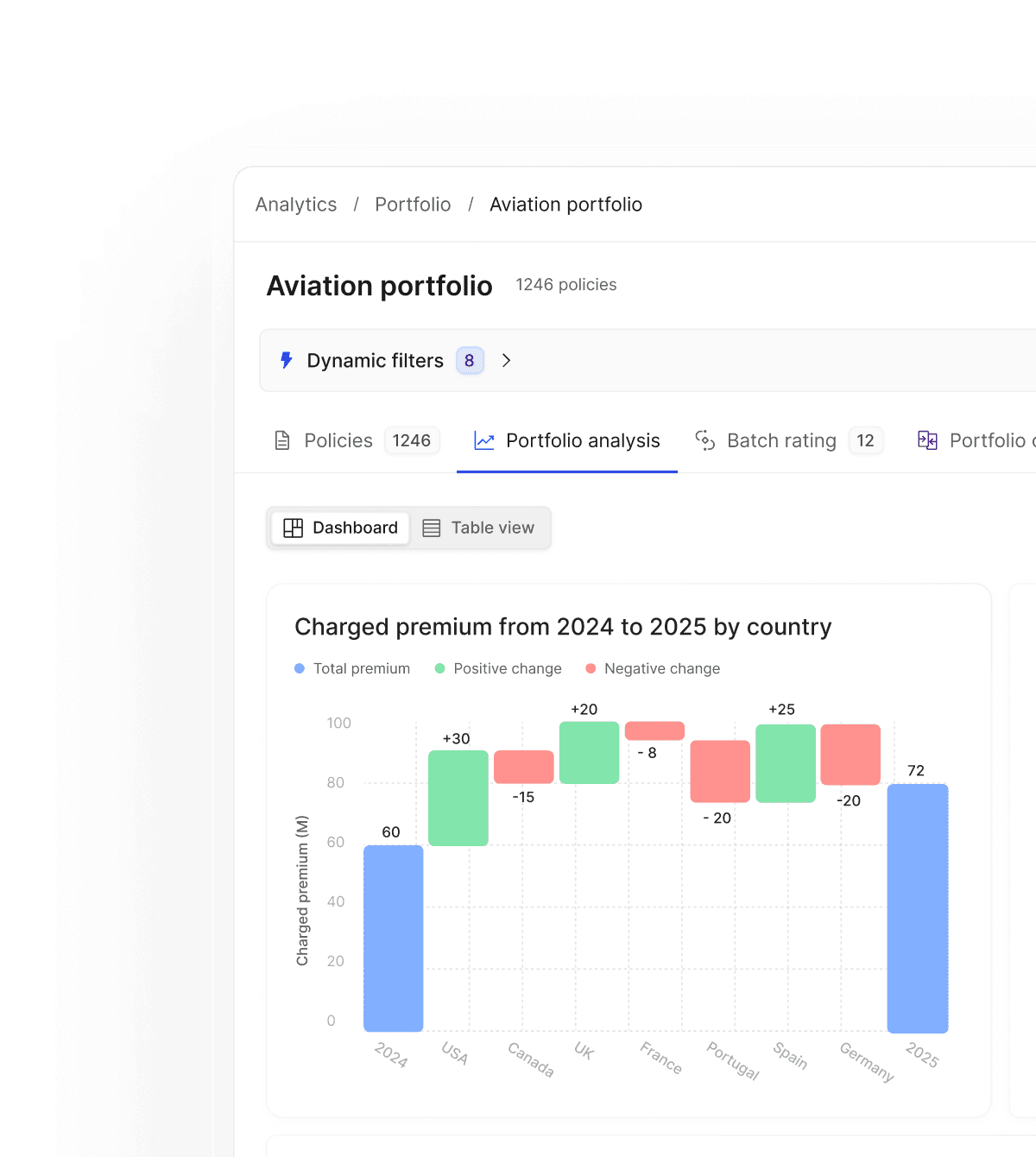

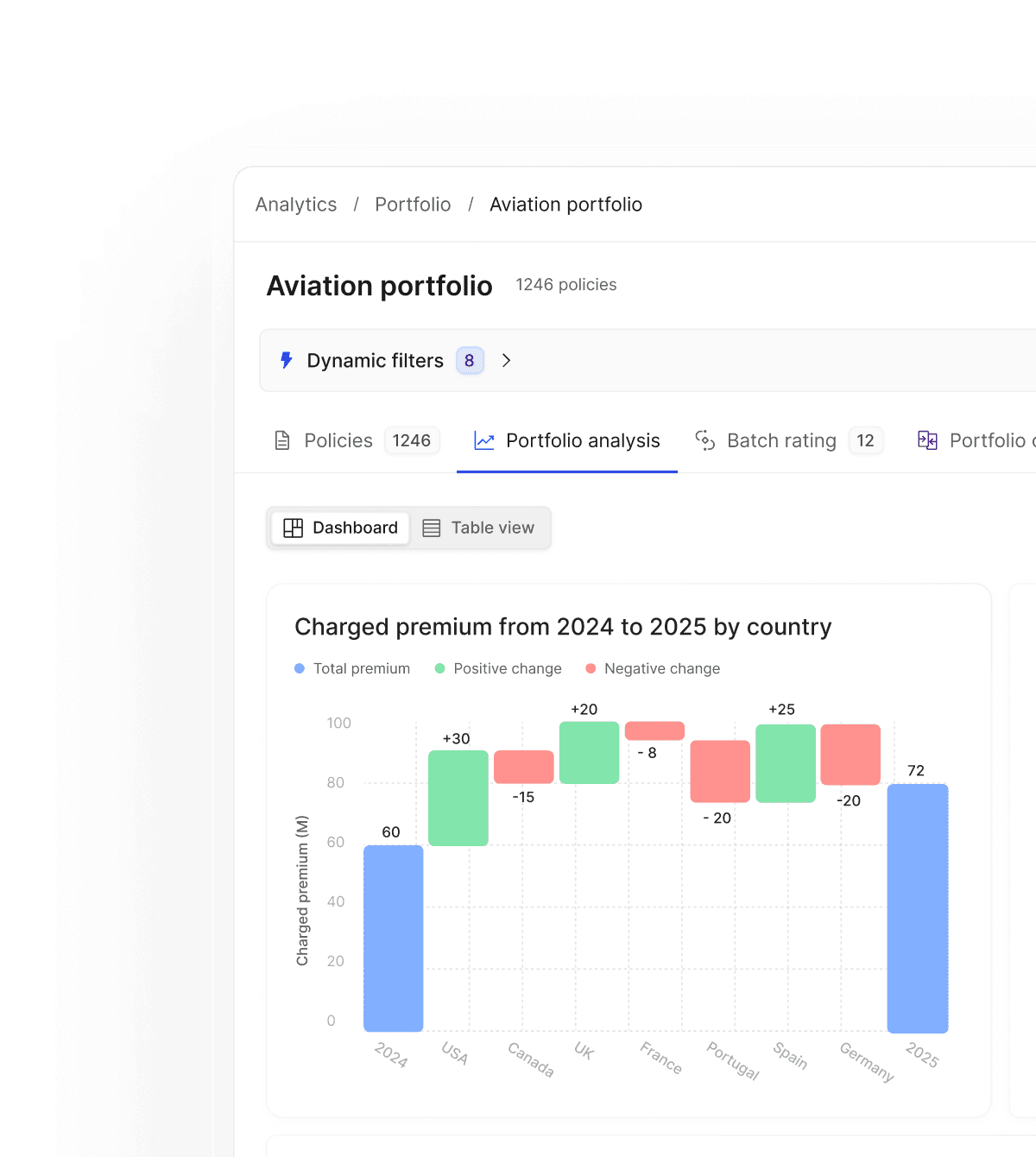

Portfolio reporting

Unlock actionable insights and KPIs across your underwriting portfolio to track performance and pinpoint improvement opportunities.

Monitor mix, profitability, and trend movements in one place to guide confident, data-backed decisions.

Portfolio reporting

Unlock actionable insights and KPIs across your underwriting portfolio to track performance and pinpoint improvement opportunities.

Monitor mix, profitability, and trend movements in one place to guide confident, data-backed decisions.

Portfolio reporting

Unlock actionable insights and KPIs across your underwriting portfolio to track performance and pinpoint improvement opportunities.

Monitor mix, profitability, and trend movements in one place to guide confident, data-backed decisions.

Dislocation analysis

Instantly visualize the distributional impact of rate changes across segments to understand who wins, who loses, and why.

Support strategic planning and regulatory requirements with clear, defensible views of change.

Dislocation analysis

Instantly visualize the distributional impact of rate changes across segments to understand who wins, who loses, and why.

Support strategic planning and regulatory requirements with clear, defensible views of change.

Dislocation analysis

Instantly visualize the distributional impact of rate changes across segments to understand who wins, who loses, and why.

Support strategic planning and regulatory requirements with clear, defensible views of change.

Rate iteration

Rapidly test, refine, and compare rate updates directly within the batch rating workflow to identify the best pricing approach.

Shorten iteration cycles by seeing portfolio impacts immediately and adjusting assumptions with precision.

Rate iteration

Rapidly test, refine, and compare rate updates directly within the batch rating workflow to identify the best pricing approach.

Shorten iteration cycles by seeing portfolio impacts immediately and adjusting assumptions with precision.

Rate iteration

Rapidly test, refine, and compare rate updates directly within the batch rating workflow to identify the best pricing approach.

Shorten iteration cycles by seeing portfolio impacts immediately and adjusting assumptions with precision.

Waterfall impact analysis

Chain batch runs together to build step-by-step impact views that isolate the effect of each change.

Reveal underlying portfolio dynamics so teams can explain outcomes clearly and choose the most effective levers.

Waterfall impact analysis

Chain batch runs together to build step-by-step impact views that isolate the effect of each change.

Reveal underlying portfolio dynamics so teams can explain outcomes clearly and choose the most effective levers.

Waterfall impact analysis

Chain batch runs together to build step-by-step impact views that isolate the effect of each change.

Reveal underlying portfolio dynamics so teams can explain outcomes clearly and choose the most effective levers.

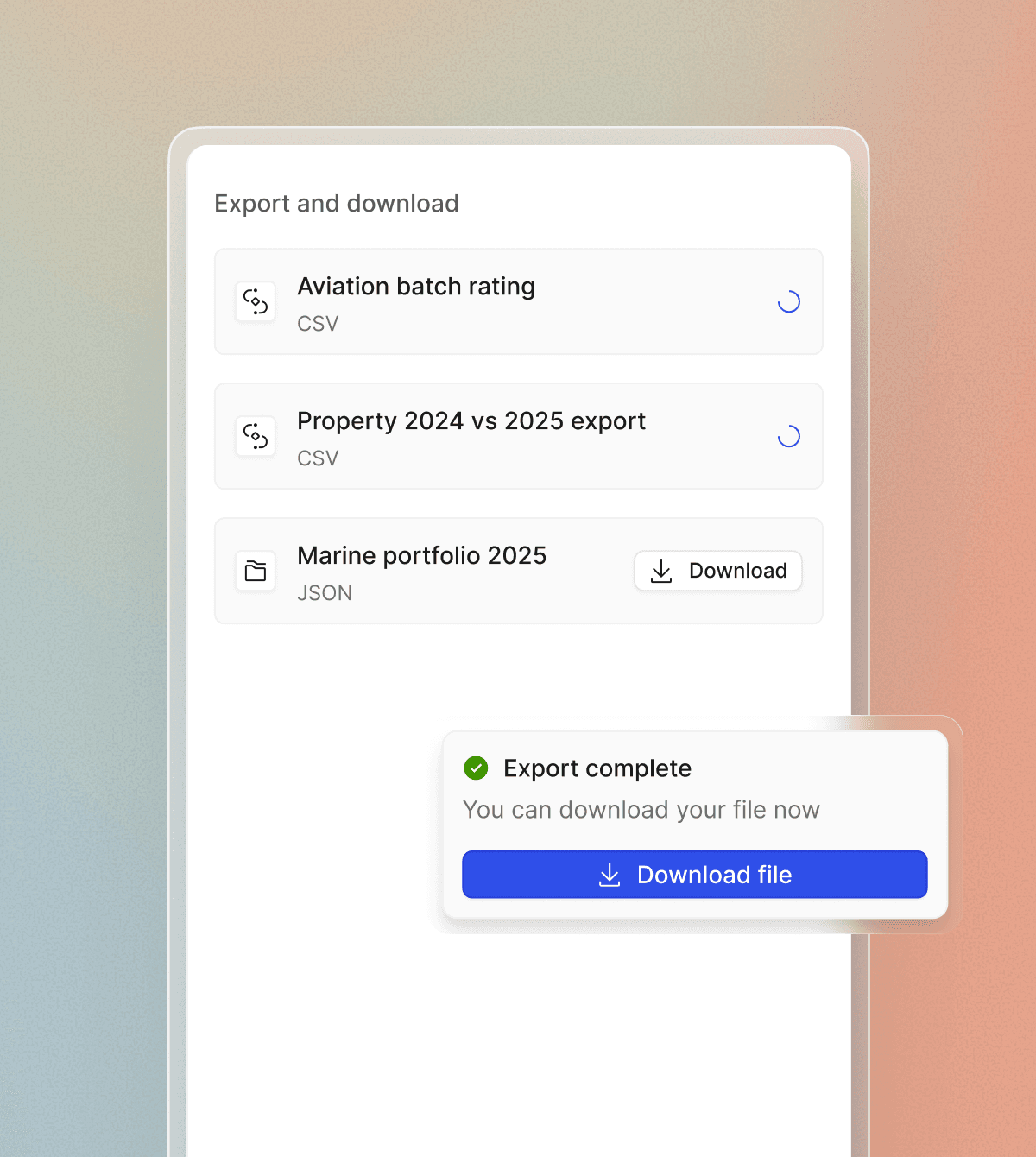

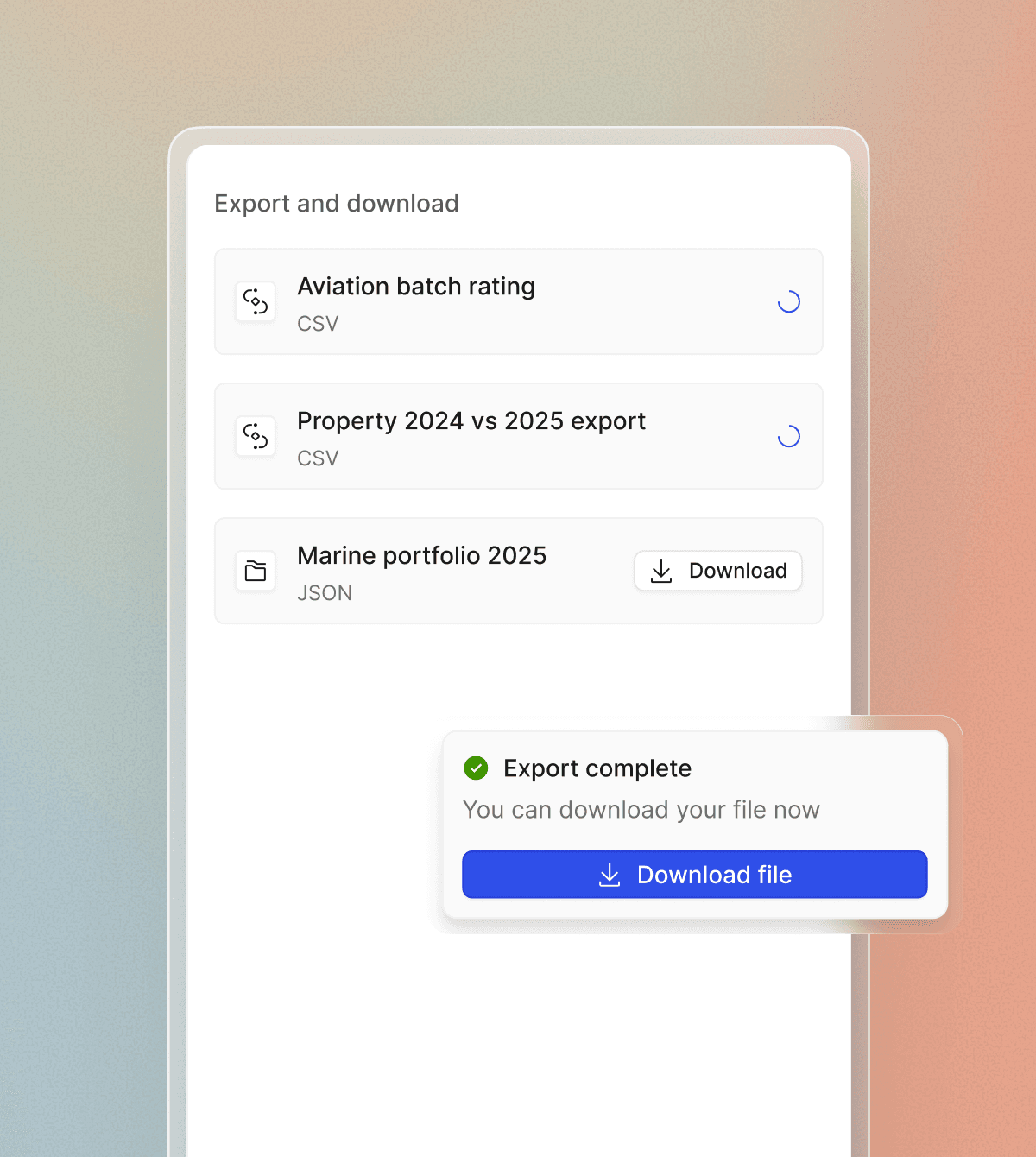

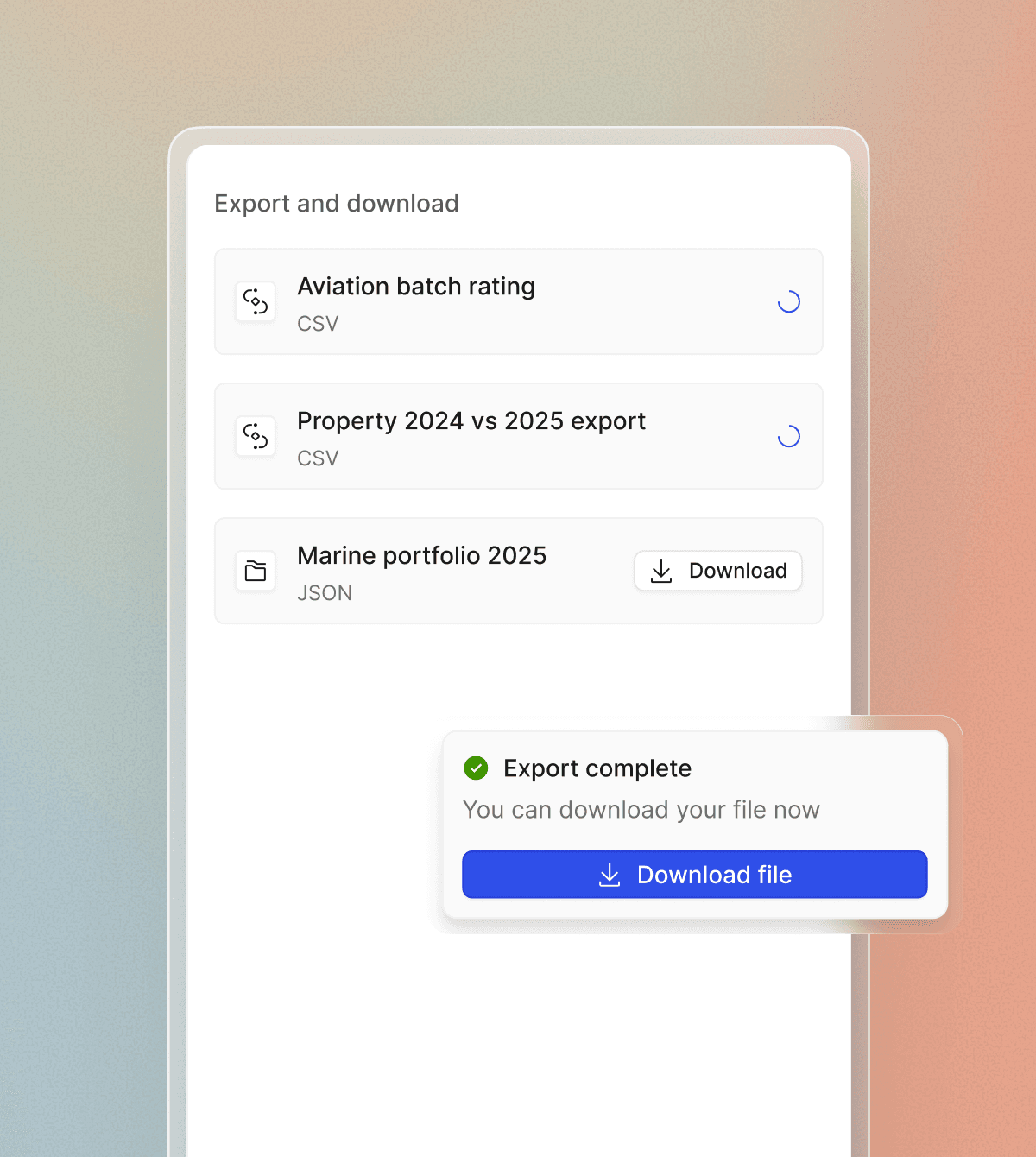

Data & API integration

Access batch results in-platform or export them to data lakes and warehouses for downstream analysis and reporting.

Trigger model runs and retrieve outputs via flexible APIs to integrate pricing workflows into your broader data ecosystem.

Data & API integration

Access batch results in-platform or export them to data lakes and warehouses for downstream analysis and reporting.

Trigger model runs and retrieve outputs via flexible APIs to integrate pricing workflows into your broader data ecosystem.

Data & API integration

Access batch results in-platform or export them to data lakes and warehouses for downstream analysis and reporting.

Trigger model runs and retrieve outputs via flexible APIs to integrate pricing workflows into your broader data ecosystem.

Enterprise grade security

and compliance

Enterprise Security

SOC2 Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Enterprise Security

SOC2 Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Enterprise Security

SOC2 Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

Accelerate your journey

from submission to decision

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018