Fixing feedback loops between underwriters and actuaries

3 minutes

Strong collaboration between underwriters and actuarial teams are essential for driving stronger risk-adjusted returns.

In the Specialty and Commercial insurance market, strong feedback loops between underwriters and actuaries are essential to performance.

Underwriters operate on the front lines, navigating client demands, broker negotiations, and turbulent market dynamics.

Actuaries work behind the scenes to bring rigour, data-driven insight, and portfolio discipline.

Both are essential - yet in many organizations, these teams remain disconnected technically, operationally, and even culturally.

95% of insurers say their pricing technology needs improvement.

Over half of underwriters believe current tools slow them down or fail to meet the market demands.

40% say models are no longer fit for purpose.

This isn’t just a technology issue - it’s a problem that manifests in portfolio performance, risk assessment, and, ultimately, loss ratios. When pricing systems fail to support cross-functional collaboration, the result is inconsistency in pricing, subpar models, and missed opportunity.

When underwriters don’t see the value in pricing models, they often revert to off-model workarounds, including manual or ad hoc calculations. This undermines consistency and weakens the feedback loop. Establishing trust, transparency, and clear communication between actuaries and underwriters is essential to ensure pricing workflows are followed as designed. If models aren’t being used, valuable data is lost, limiting the ability to recalibrate models in line with evolving market conditions. Over time, this deepens the disconnect.

What's causing the disconnect?

The gap between underwriters and actuaries is rarely intentional. It’s caused through friction - by fragmented workflows, hard-to-maintain pricing models, and a lack of clarity over how technical prices are output. It’s a communications problem as much as it is a technical one.

The leading root causes of this disconnect are:

Feedback loops: When underwriters surface insights or market changes, they often need to wait weeks or months for model updates that reflect the changes

Poor information flows: If an underwriter isn’t clearly shown why a model is pricing a certain way, trust erodes. Particularly if the output of the model goes against their own judgement. This often inspires underwriters to create parallel tools, which are siloed, ungoverned, and unaccounted for.

Fragmented workflows: Actuaries and underwriters often operate in different systems, duplicating effort and losing critical context. It results in underwriters manually entering information into multiple systems, manually creating or requesting reports, and a slower quote-to-bind cycle. All of which can build frustration.

Communication gaps: If a third function, such as IT, is required to update and adapt pricing tools, they can end up acting as go-between from actuaries to underwriters and vice versa. This can create an accidental game of telephone and add a further point of failure where feedback gets diluted and communication channels hit bottlenecks.

The impact of broken feedback loops

The operational impact is clear - inefficiency, inconsistent practices, and unaccounted for workarounds that impact pricing efficiency. But the strategic cost is higher: Insurers lose agility, models become stale and both teams operate below their potential. As a result - overall performance suffers.

There’s also a critical strain put on culture. Underwriters feel constrained by tools they don’t trust. Actuaries feel sidelined when their models are ignored. Neither team is wrong - they’re just not equipped to work in sync. This is where a unified pricing and underwriting platform can support.

hx Renew fixes the disconnect

hx Renew is purpose-built to bridge the collaboration gap between actuaries, underwriters and all the parties that huddle around a risk - empowering pricing teams to work faster, align more closely, and make smarter decisions together.

Building confidence in pricing models

Confidence in pricing starts with the quality of the model. hx Renew gives actuaries the tools to build more accurate, adaptable models by seamlessly integrating third-party data, APIs, and advanced analytics. With support for sophisticated catastrophe loss and risk modelling techniques, actuaries can better capture and represent complex risks across different product lines. The result is a more complete and credible view of risk—one that underwriters can trust, use, and engage with. Stronger models lead to stronger adoption, helping to close the feedback loop between data, pricing, and decision-making.

Clarity over pricing logic

Underwriters need to understand how a technical price has been calculated in order to trust it. hx Renew enables better clarity around model assumptions, variables, and methodology so that underwriters can see what’s driving the price. This facilitates informed conversations grounded in shared logic, and ensures that underwriters actually engage with pricing models instead of searching out workarounds. This helps cement the virtuous feedback loop between data, analysis and decisions.

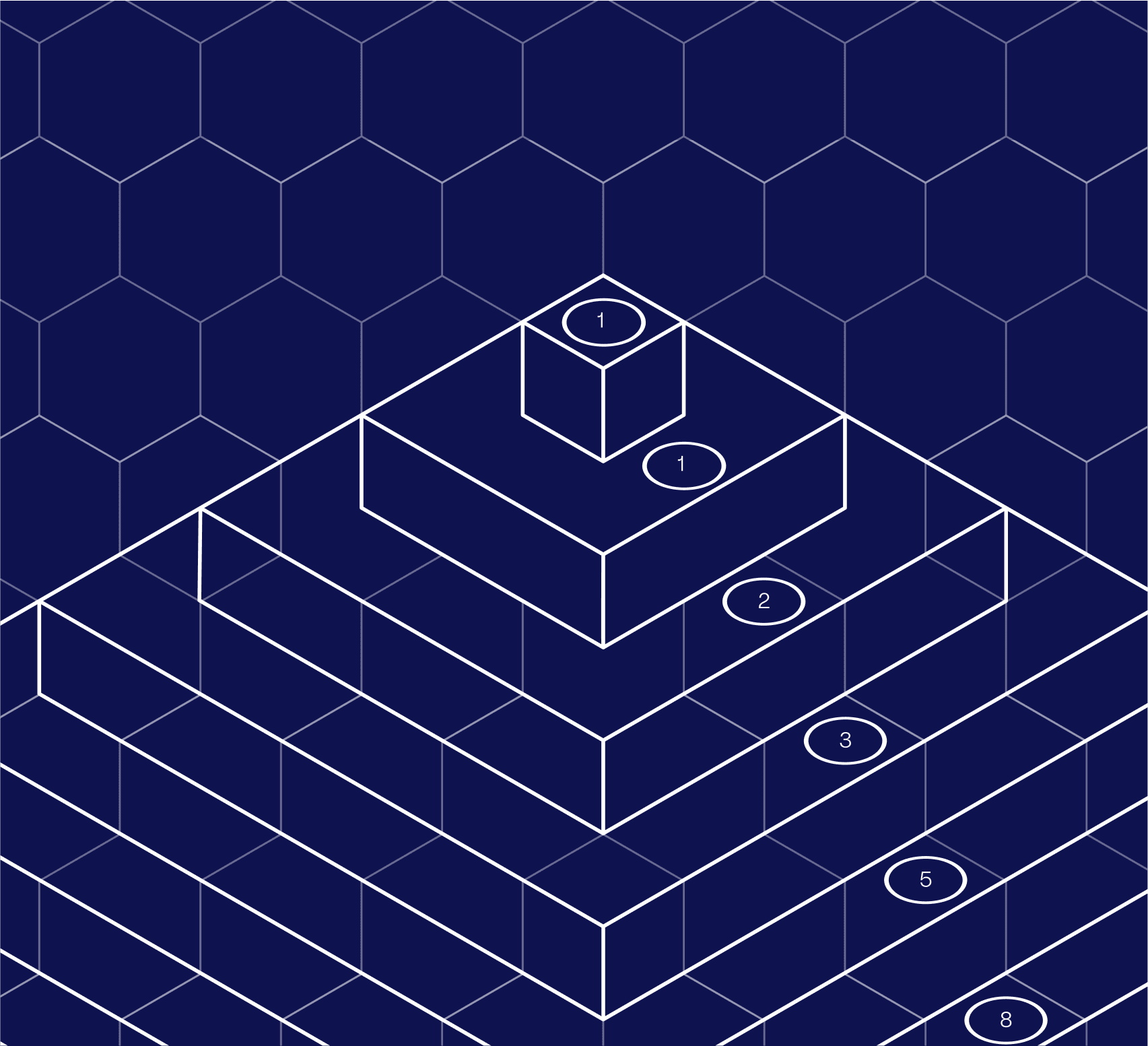

Stronger, more data-driven and optimised raters grow underwriter utilisation, creating a virtuous cycle.

Faster model updates that reflect market insight

Underwriter feedback often surfaces emerging market factors that models need to reflect. With Renew, actuaries can quickly incorporate that feedback and update models without waiting on IT or formal release cycles. This means fewer workarounds, less off-model pricing, and a more consistent, joined-up approach. Underwriters can see their insights reflected in the pricing tools they rely on - boosting trust and reducing fragmentation.

Configurable interfaces that support real-time decision-making

Renew allows insurers to tailor pricing model interfaces to match the way underwriters actually work. That includes bringing relevant data and insights - like portfolio fit, historical comparisons, and visual risk indicators - directly into the point-of-pricing workflow. Underwriters no longer need to re-analyse risks manually or interpret model outputs in isolation. They can act faster, with more confidence, and give feedback in-platform to ensure their perspective shapes future models, not just individual decisions.

hx Renew makes actuary-underwriter collaboration frictionless and painless

See how hx Renew empowers underwriters to collaborate seamlessly with actuaries, price with confidence, and move faster - backed by transparent logic, real-time insights, and smarter workflows.

Request a demo today and discover how Renew can help you take control, stay competitive, and shape the future of pricing.