5 eye-opening stats on the state of pricing in reinsurance in 2023

Pricing decision intelligence for reinsurers

Pricing decision intelligence for reinsurers

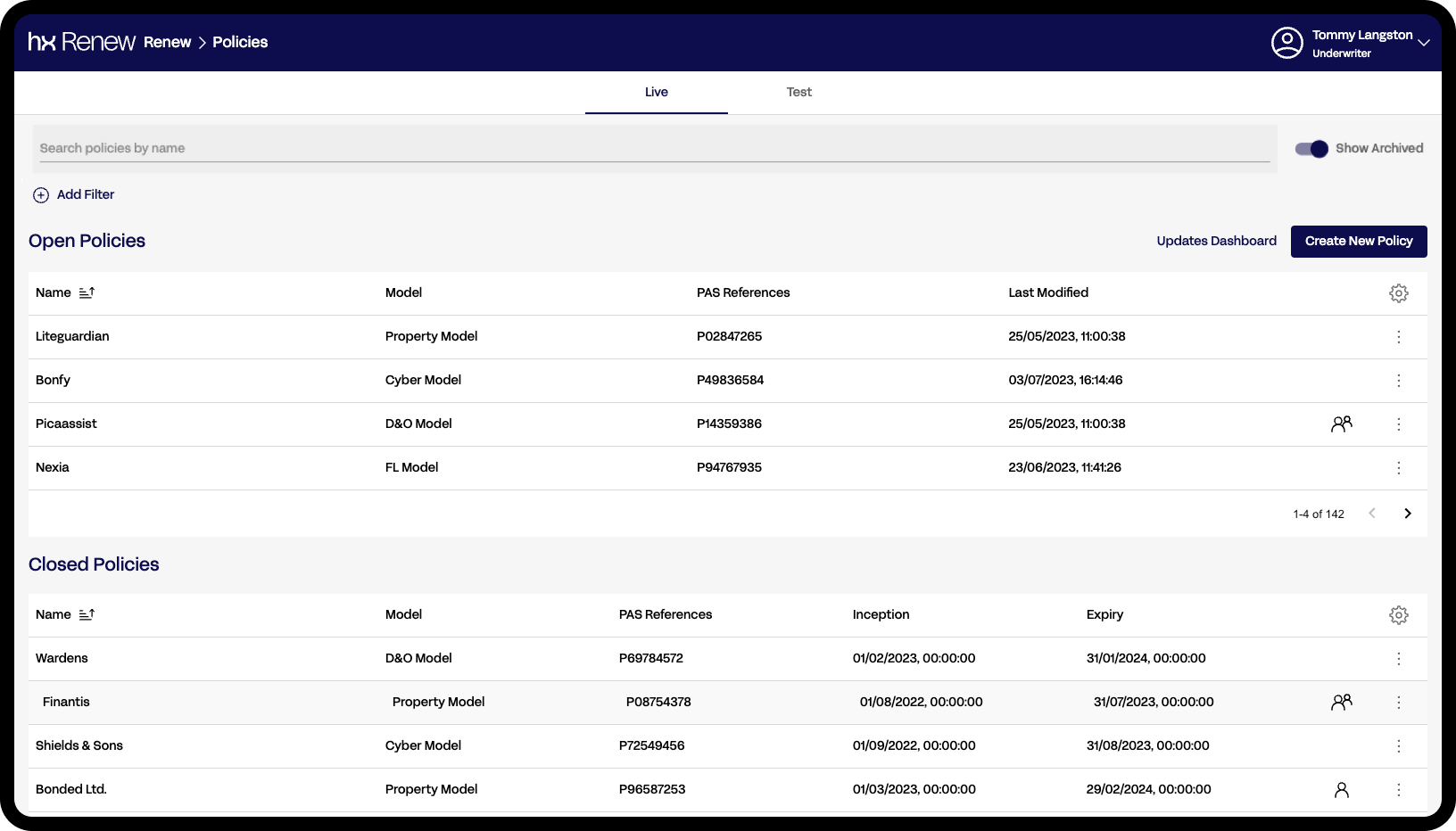

hx Renew offers something new: powerful tools, flexible integrations, and an intuitive, connected workflow between actuaries and underwriters, helping you eliminate admin and deliver growth.

When it comes to pricing complex risk, out of the box solutions simply won't do. Home-grown tools offer a customized alternative, but they struggle to scale and are prone to break — especially during busy renewals seasons.

Legacy technology lacks the required capabilities and flexibility for complex data analysis, modelling techniques, and advanced algorithms. This hinders accurate risk assessment, impedes decision-making, and inhibits the ability to respond quickly to market changes.

Rapid peer review processes accelerate quote to submission

More data and insights available at the point of pricing

Integration with wider ecosystem for streamlined workflows

Build sophisticated reinsurance pricing models

Leverage real-time data and portfolio level insights

Conduct what-if analysis and run exposure scenarios

Embed business rules and compliance controls into the pricing process

Built in versioning and audit trails for model comparison and compliance

Apply roles-based governance processes around model releases

Research, news, and opinions to help insurers make intelligent decisions