5 ways hx Renew helps modern reinsurers make better pricing decisions

6 minutes

Explore how hx Renew helps reinsurers navigate an ever-changing risk market and unlock up to 3-6%pt combined ratio improvements through data driven pricing decisions.

After years of limited performance, a hard reinsurance market presents a unique opportunity.

With the biggest reinsurance capital squeeze since 2008 currently underway, reduced capacity will increase reliance on fast, responsive, and accurate pricing as a key growth lever. Reinsurers that can successfully leverage this uncertainty and, in turn, price most effectively will be best placed to lead the market. Here's how hx Renew can help.

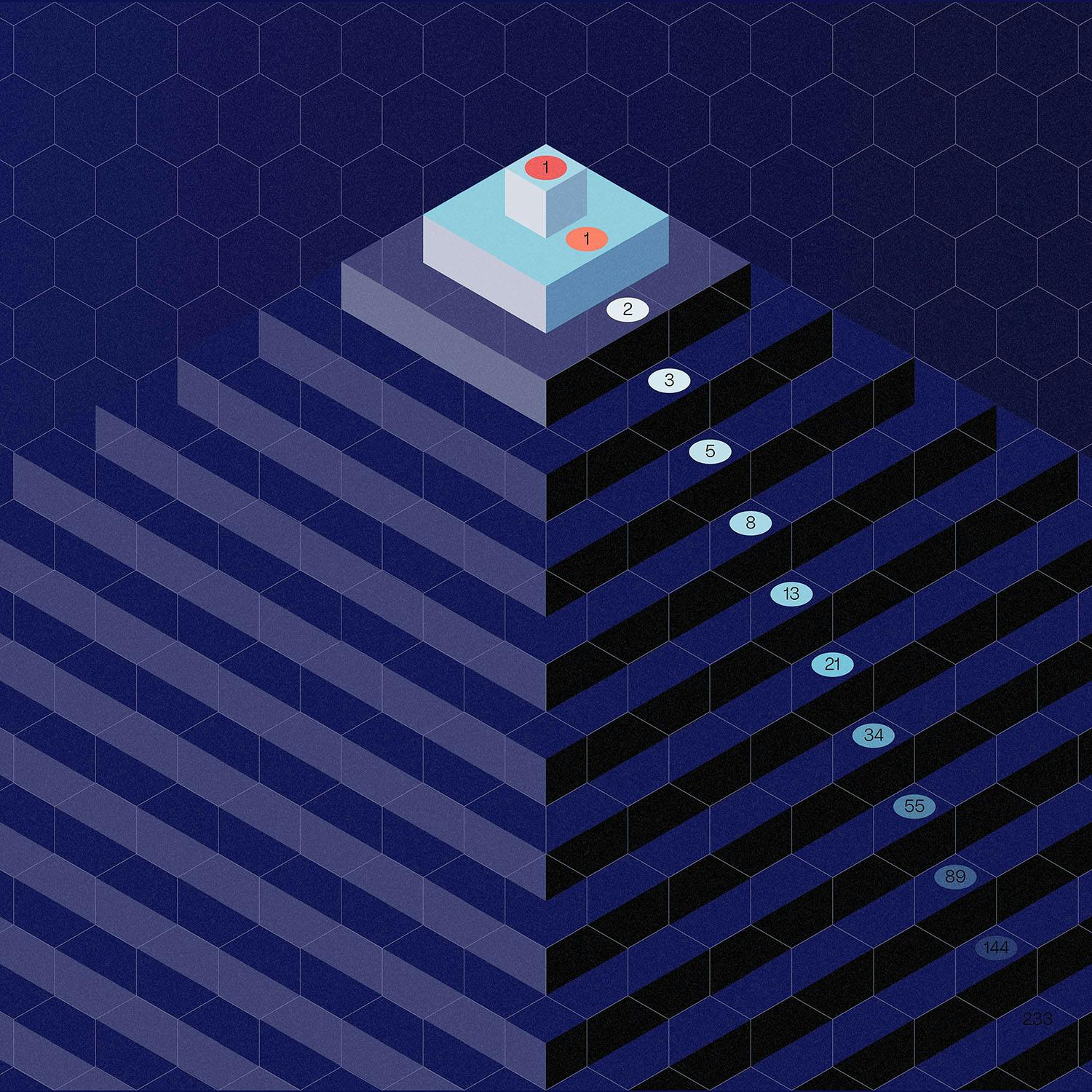

1. Steer your portfolio with real-time rate-change data

With traditional solutions, underwriters, actuaries, and their executives are unable to consistently monitor rate change across the business due to pricing data not being readily available in a database for reporting and portfolio analysis. Many reinsurers spend as much as three weeks per quarter on manual data collection, amounting to the loss of valuable time and up to 100k per year. In addition, reinsurers are stuck relying on months-old information, unable to make essential business decisions based on real-time data.

hx Renew provides real-time rate change monitoring through automated dashboards which show technical and achieved prices in real-time, on an individual as well as portfolio level.

Databases are created and updated automatically thanks to API integrations with MI tooling, enabling more effective risk selection and improved portfolio analysis.

2. Run scenario analyses

The ability to assess the marginal impact on your portfolio from (a) model updates and (b) assumption changes such inflation unlocks unrivalled agility in your decision-making.

However, most reinsurers are hampered by legacy tools that are unable to batch rate. This leaves reinsurers blind to the risks and opportunities present in their portfolio — and less able to understand the impact of decisions and drive future profitability.

With hx Renew, actuaries and underwriters collaborate seamlessly, thanks to our agile, web-based SaaS platform enabling the development and refinement of pricing models at speed, automated batch-testing and ‘what-if’ analysis, plus automated regression testing for calculation errors.

3. Iterate on your internal tools

Making changes to models shouldn’t be painful. With Excel, initial updates may be quick (or not!), yet with no version control or governance around testing and approvals, reinsurers quickly find themselves having to choose between speed, data credibility, and quality governance.

To better enable their underwriting teams, actuaries need to be able to refine models quickly, by themselves, at no cost, with version control and rigorous testing.

This can save reinsurers up to one month per year that would otherwise be spent correcting incorrect technical premiums created in other tools. Algorithm and rate changes can be made in days, not weeks, and customers achieve full compliance with regulatory standards without IT and vendor costs.

“The implementation of our pricing models in hx Renew has allowed us to react more quickly when making changes to our inflation methodology as well as enabling self-serve updating of parameter tables.”

Andrew Couper, Chief Actuary, Conduit Re

4. Develop management information

Reporting on pricing data for use by actuaries, underwriters, and executives is usually a highly manual process and often difficult, if not impossible, to deliver consistently across all lines of business.

With hx Renew, databases are automatically generated as you build models and are available in real-time through our APIs. This means that portfolio-level data is instantly accessible from the platform, allowing you to

Rapidly summarise and analyse portfolio data

Develop internal benchmarks

Monitor rate-change across your portfolio

Empower underwriters to assess the marginal impact of risks on your portfolio

Enriching pricing data is critical to future profitability and competitiveness. hx Renew enables easy data ingestion through API connections to external data sources and captures unstructured data through web scraping, enriching the data available for future pricing and eliminating the need for rekeying.

"No data put into hx Renew is lost. With Excel, everything gets trapped in a spreadsheet and is unusable in the long run. In hx Renew, we can aggregate all of our pricing data, for example, by line of business, and use that to create our development factors. The ability to move a case easily from one year to the next to help with renewing the policy is valuable for the team."

Stuart Quinlan, Conduit Re Deputy Chief Executive & Chief Operations Officer

5. Reduce quote turnaround time

Collaboration between actuaries, underwriters and the technology that sits between them is critical to rapid quote turnaround, particularly during busy renewal periods.

But when we surveyed reinsurers about typical pricing processes, we discovered that business-as-usual tasks that could take minutes and hours, were taking days, weeks and even months.

Underwriters spend as much as 3 hours per day re-keying data that could easily be pulled into models from PAS systems in seconds. Peer review processes take, on average, 11 days. And simple parameter changes to models take as long as 46 days!

Whether it’s pulling in Nat Cat data via API from providers like RMS and AIR, or automatically populating pricing models with data from PAS systems, hx Renew’s data ingestion capabilities allow actuaries and underwriters to access a universe of relevant data at the point of pricing. Meaning less time spent re-keying, tab switching and copy-pasting. More time spent analysing, reviewing and binding risks.

Your pricing transformation starts here

To learn about the impact of hx Renew first-hand, book a call. Our experts can provide custom advice on pricing transformation for your organization.