Underwriting

The risk of poor governance in insurance pricing and underwriting

Apr 4, 2025

Poor governance leads to fragmented and unstable systems that hinder growth. Here's how to introduce seamless governance to pricing workflows.

One of the most persistent threats to effective risk assessment lies in uncatalogued change—latent, systemic issues that quietly compromise the organisation’s ability to assess, price, and manage risk with confidence.

Weak governance is characterised by uncontrolled changes to pricing models, undocumented assumptions, unclear ownership, untracked access, and the absence of structured review processes. These conditions erode internal confidence, impair the ability to coordinate effectively across teams, and result in a fragmented view of both pricing logic, and the assumptions its based on.

In this article, we review what good governance looks like for insurance businesses, and the technology they can tap into to reap the benefits.

What is good pricing model and underwriting governance?

Strong governance is a necessity for safe, repeatable, and scalable decision-making. It encompasses:

Access controls to safeguard proprietary pricing logic, prevent unintentional or unauthorized edits, and reduce the risk of malicious sharing of sensitive data. This protects intellectual property, strengthens regulatory alignment, and reinforces overall model integrity.

Version control to track changes, maintain full traceability of model updates, and support parallel development through forks and branches.

Audit trails to enable investigation, compliance reporting, regulatory defensibility, and full traceability of decision-making—ensuring that every change is recorded, attributable, and reviewable in the context of both internal governance and external oversight.

Peer reviews to enforce structured oversight, increase accountability, and promote good working practices that encourage collaboration and information sharing—ensuring that knowledge is distributed across the team rather than concentrated and siloed among individual contributors, thereby de-risking operations.

When these practices are absent or weak, insurers expose themselves to inconsistent pricing decisions, fragmented communication across teams, and degraded trust in model outputs. Without these safeguards, insurers may find governance becoming a barrier rather than an enabler.

What are the risks of poor governance to insurers?

Poor governance leads to fragmented and unstable systems that hinder growth. Insurers should be aiming to design governance frameworks that harness technology to support seamless expansion and unlock the full potential of actuarial and underwriting expertise.

This manifests in several critical ways:

Reputational risk: Undetected model errors can reach the market and damage broker and client trust.

Regulatory risk: Inability to demonstrate the rationale behind pricing decisions can invite scrutiny or penalties.

Portfolio risk: Lack of model consistency and traceability hinders effective portfolio steering and strategic decision-making.

Scaling risk: Poor governance makes it difficult to scale teams effectively. Without streamlined collaboration and embedded controls, governance responsibilities often fall disproportionately on the most experienced individuals. This centralisation of knowledge increases operational risk and creates bottlenecks, leading to inefficiencies that scale in line with quote volumes and model deployments.

Workforce experience risk: Fragmented and manual governance processes can degrade the working experience of actuaries and underwriters. Cumbersome workflows, reliance on offline documentation, and unclear ownership can lead to frustration, job dissatisfaction, and a higher risk of human error.

In the absence of robust governance, pricing models often become fragmented across teams, resulting in a lack of consistency and a missing single source of truth.

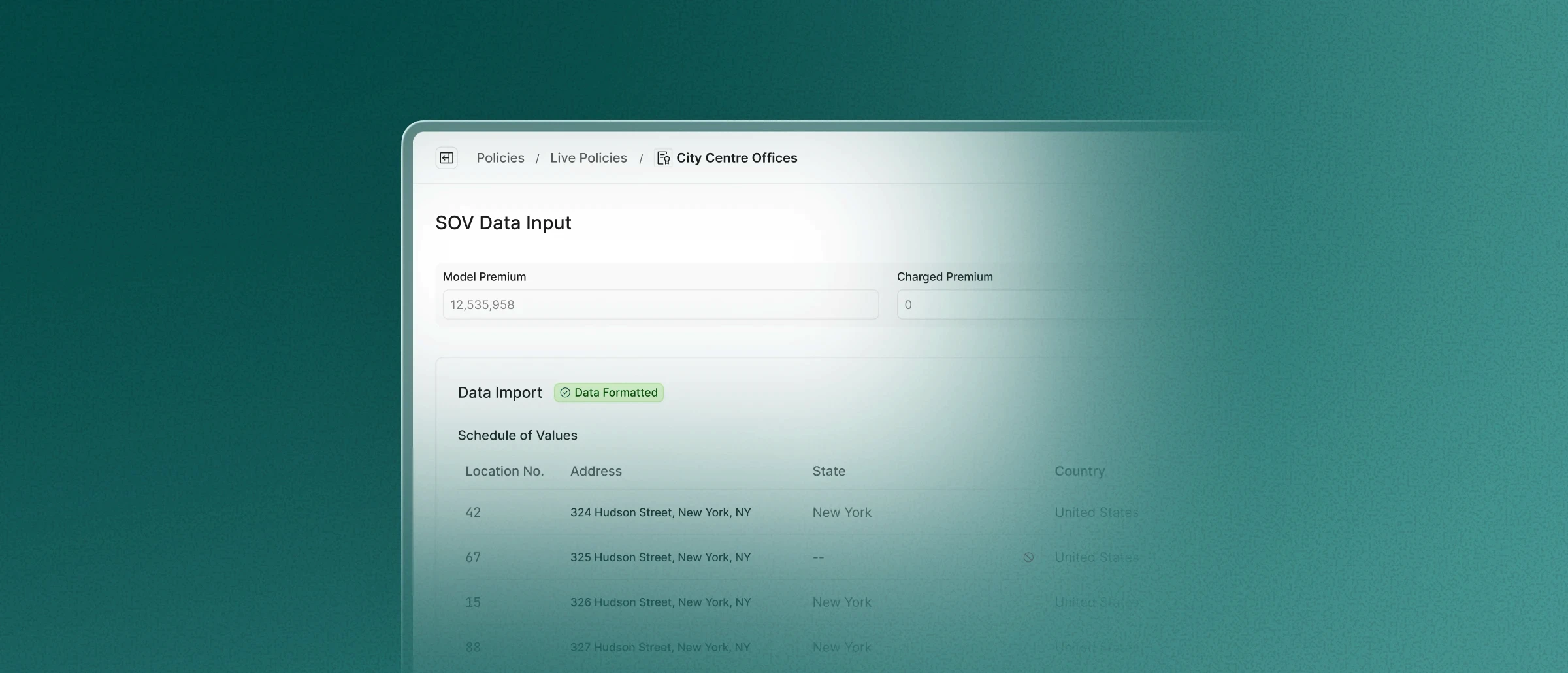

How hx Renew introduces seamless governance

hx Renew addresses these challenges by embedding governance directly into the pricing workflow. Renew integrates essential controls within a unified platform. This reduces the burden on actuarial and underwriting teams and ensures that governance strengthens, rather than distracts from, their core responsibilities.

With Renew, insurers gain access to:

Granular version control and audit logs, providing complete traceability and historical context for every change. This eliminates the need for manual tracking, ensures that model evolution is transparent, and reduces the risk of inconsistency or error during model development and deployment.

Build better peer review workflows which introduce structured oversight and enable collaborative iteration. Whether that’s summarising key fields or risk assumptions in a document and sending via email to managers, or automating a Teams message with key information about the risk clearly summed up.

The peer review process could be building document generation that summarises key fields or assumptions for the risk and sends via email to managers, or a teams notification summarising key information. These are not out the box features like version control, access control and audit log but are very doable in hx and can save customers a lot of time

Role-based access permissions, which safeguard intellectual property, prevent unauthorised or accidental edits, and align user capabilities with their responsibilities. This protects sensitive logic and ensures operational boundaries are clearly maintained.

With AI here, governance matters now more than ever

As artificial intelligence and real-time data continue to reshape the pricing landscape, strong governance is no longer optional. These technologies accelerate innovation and enable new ways of working, but without embedded controls, they introduce complexity and amplify the risks of inconsistency, error, and fragmentation.

Now more than ever, insurers must treat governance as a core capability. By embedding transparent, scalable controls directly into the pricing workflow, organisations can reduce operational risk, maintain clarity as teams scale, and empower underwriters and actuaries to focus on what they do best: making sound, data-driven decisions.

Don’t let governance be the reason innovation stalls. Book a demo of hx Renew and see how governance, done right, powers pricing excellence.