Build your competitive edge

Flexible decision logic you can build, tune, and govern

Make changes to the exposure rating for this model…

Make changes to the exposure rating for this model…

Configurable logic

Flexible business logic with no-code + AI-assisted pro-code customization.

Configurable logic

Flexible business logic with no-code + AI-assisted pro-code customization.

Seamless integration

Convert Excel models and connect into your existing stack with prebuilt APIs and data connectors.

Seamless integration

Convert Excel models and connect into your existing stack with prebuilt APIs and data connectors.

Built for enterprise

Safe releases with built-in controls, plus cross-model portfolio analysis.

Built for enterprise

Safe releases with built-in controls, plus cross-model portfolio analysis.

Bring control and clarity

to pricing strategy

AI-assisted modeling

Leverage an embedded AI co-pilot to write, debug, and optimize pricing code - cutting iteration time from weeks to hours.

Easily explain code and add documentation to improve collaboration.

AI-assisted modeling

Leverage an embedded AI co-pilot to write, debug, and optimize pricing code - cutting iteration time from weeks to hours.

Easily explain code and add documentation to improve collaboration.

Python rating engine

Implement and iterate on any pricing algorithm, from simple packages to complex treaties, in a flexible pro-code environment.

Test and deploy to all underwriters in a few clicks.

Python rating engine

Implement and iterate on any pricing algorithm, from simple packages to complex treaties, in a flexible pro-code environment.

Test and deploy to all underwriters in a few clicks.

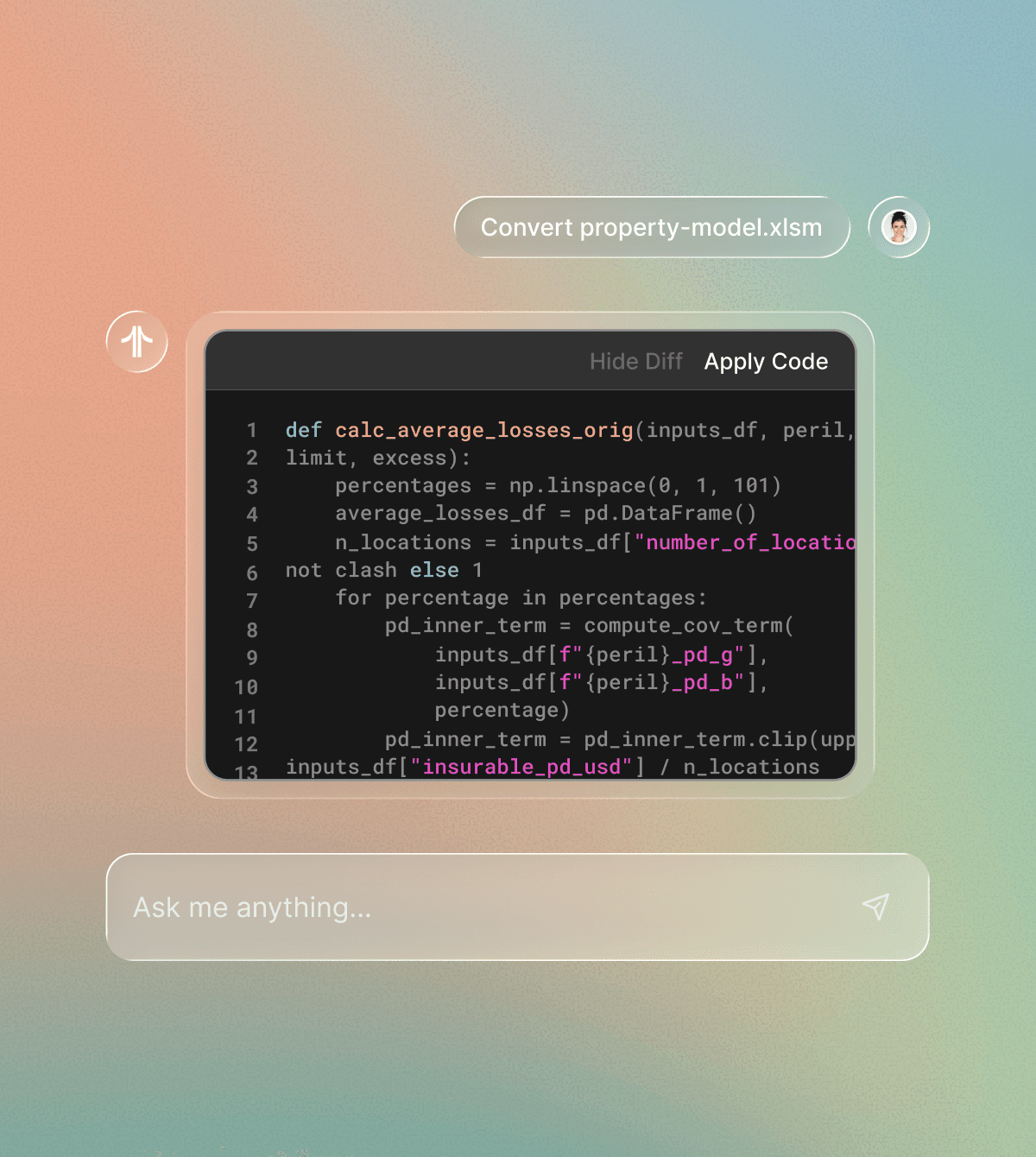

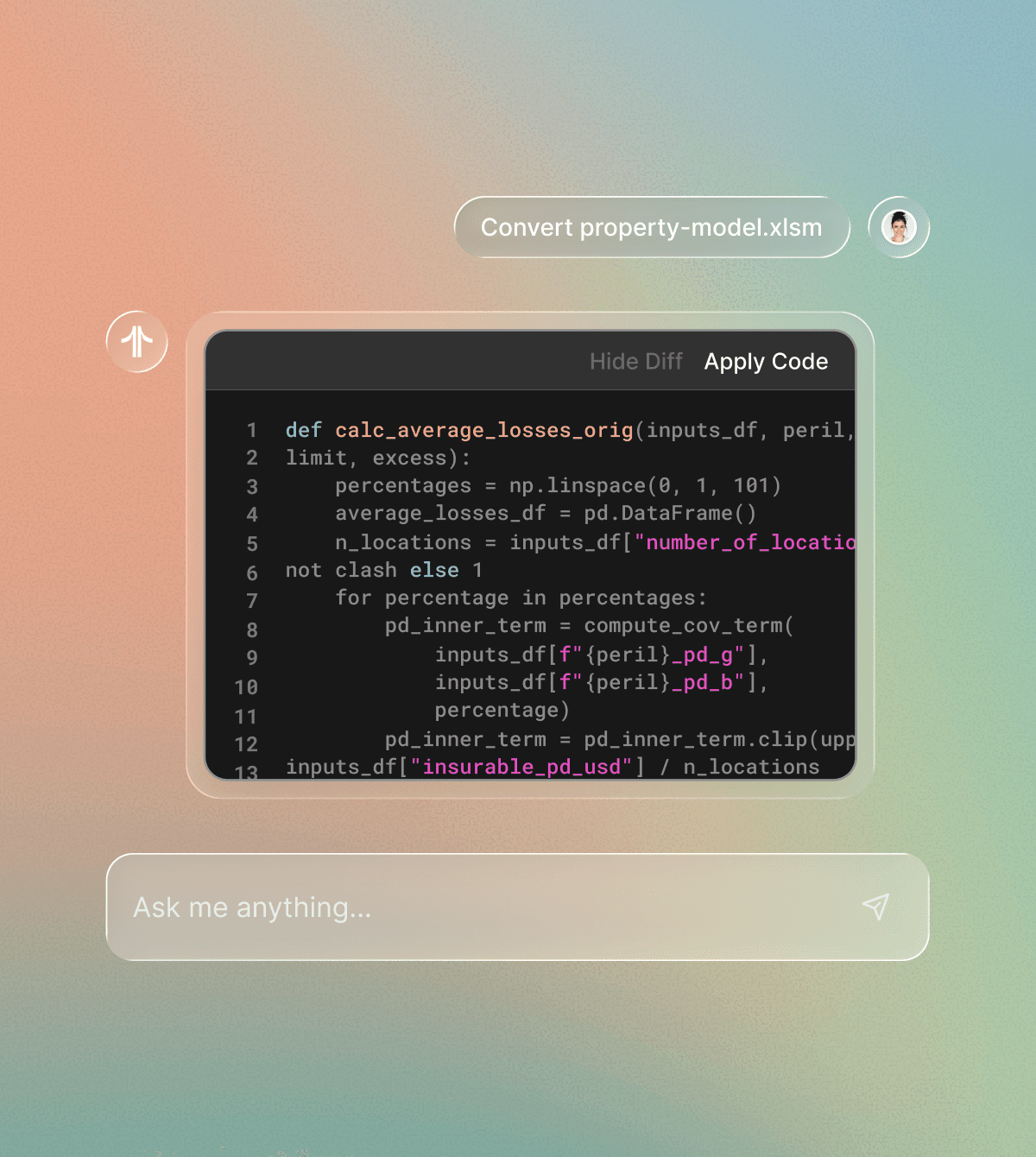

Excel model converter

Instantly convert spreadsheet raters into production-grade raters with Python backends and parameter tables.

Then easily build user-friendly underwriter experiences with an agent trained on modern UI patterns and best practices.

Excel model converter

Instantly convert spreadsheet raters into production-grade raters with Python backends and parameter tables.

Then easily build user-friendly underwriter experiences with an agent trained on modern UI patterns and best practices.

Governance & version control

Manage model changes seamlessly with built-in versioning, approvals, and audit trails from dev to production.

Build in clear override paths and review steps so AI never becomes a black box.

Governance & version control

Manage model changes seamlessly with built-in versioning, approvals, and audit trails from dev to production.

Build in clear override paths and review steps so AI never becomes a black box.

Cross-model analysis

Centralize pricing data and portfolio analytics to accelerate iteration with an end‑to‑end feedback loop.

Run scenario testing and optimization across multiple models to surface pricing opportunities and risks.

Cross-model analysis

Centralize pricing data and portfolio analytics to accelerate iteration with an end‑to‑end feedback loop.

Run scenario testing and optimization across multiple models to surface pricing opportunities and risks.

Connected APIs & ecosystem

Integrate seamlessly into workbenches, PAS, broker portals, or the wider hx Platform - no rekeying required.

Access third-party data at the point of pricing to strengthen decision-making.

Connected APIs & ecosystem

Integrate seamlessly into workbenches, PAS, broker portals, or the wider hx Platform - no rekeying required.

Access third-party data at the point of pricing to strengthen decision-making.

Enterprise grade security

and compliance

Enterprise Security

SOC2 Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Enterprise Security

SOC2 Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

"By leveraging hx AI, we're evaluating how artificial intelligence can augment the expertise of our underwriters and brokers.

This includes enhanced pricing precision, optimising workflows and supporting smarter, faster decision-making across ourt GCS portfolio and beyond."

Karen Dayal

Chief Underwriting Officer, Aviva

"By partnering with hx, we're making intelligent underwriting a reality for our Global Corporate & Specialty business"

Karen Dayal

Chief Underwriting Officer, Aviva

Accelerate your journey

from submission to decision

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018