The underwriting decision platform for US admitted carriers

hx combines best-in-class rate governance with a modern, end-to-end platform for pricing, underwriting, and portfolio insight.

Manage rate changes, triage submissions, and quote confidently with state-specific DOI compliance - all in one connected platform built for admitted workflows.

Eliminate rate deployment delays and compliance risk

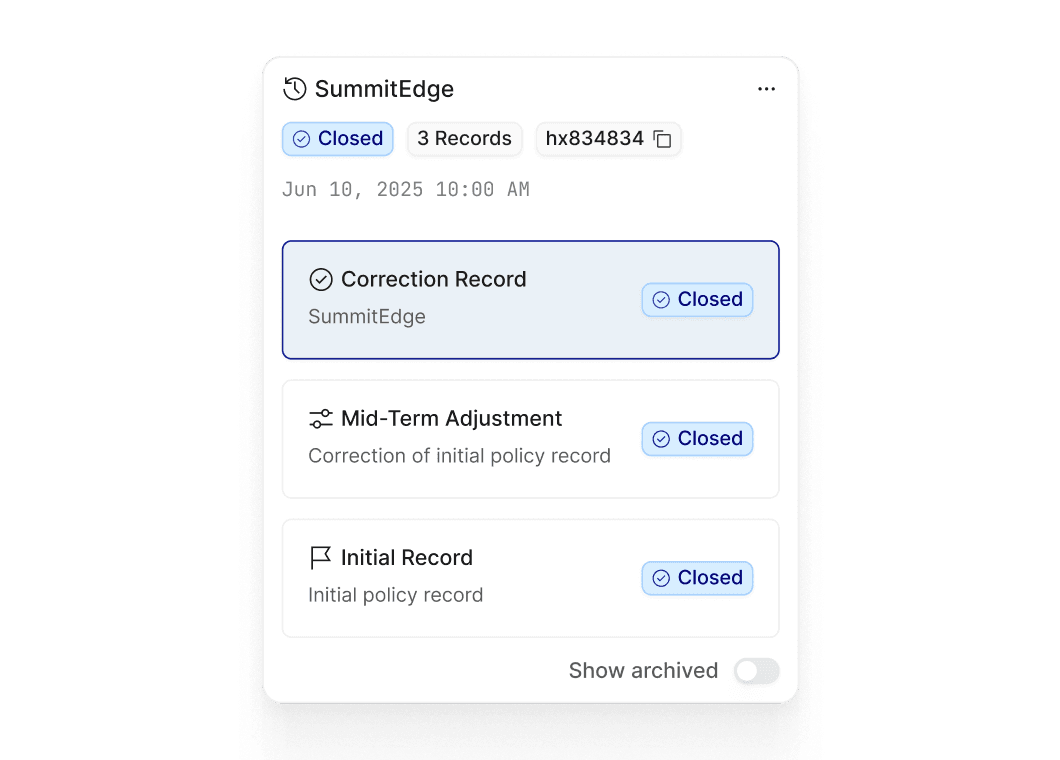

Centralize filed rate management in one governed workspace. Update, validate, and deploy rate changes with confidence backed by full version control, effective date governance, and audit trails. Approved rates reach underwriters faster and stay fully compliant - turning deployment into a smooth, efficient process.

Accelerate rating and underwriting in a governed environment

Streamline rating, risk assessment, and underwriting review in one secure, governed space - so underwriters make faster, more consistent decisions with complete pricing context. Build and maintain performant, connected pricing tools that keep models aligned across teams.

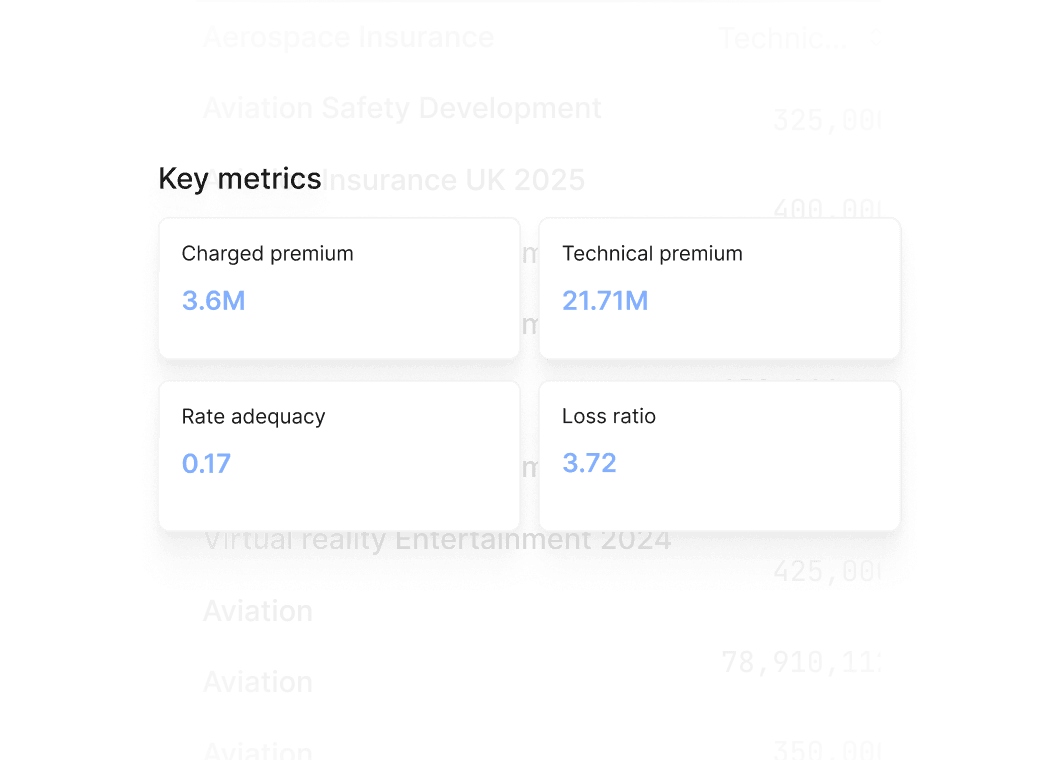

Run continuous portfolio analysis to protect profitability

Perform dislocation analysis, adequacy testing, and rate impact assessments in real time. Visualize portfolio shifts and feed insights directly into rate deployment and portfolio strategy - turning analysis into confident, compliant action.

Everything you need to win in the Admitted market

Powering performance in the Admitted market

3-6% loss ratio improvement

Customers unlock portfolio-level analytics and rapid model development to drive loss ratio improvements

40% reduction in underwriter admin

Free underwriters from manual admin and rekeying to focus on high value risk assessment

10x faster model build

Specialty carriers using hx build and deploy new pricing tools 10x faster than legacy solutions