The underwriting decision platform for MGAs

Unlock operational efficiency, automate data sharing, and prove your underwriting edge - without growing overhead

Scale capacity, not headcount.

Automate manual tasks, streamline workflows, and eliminate rekeying so your team can focus on underwriting strategy—not admin. Grow your book without growing your costs.

Scale capacity, not headcount.

Automate manual tasks, streamline workflows, and eliminate rekeying so your team can focus on underwriting strategy—not admin. Grow your book without growing your costs.

Win and retain carrier capacity.

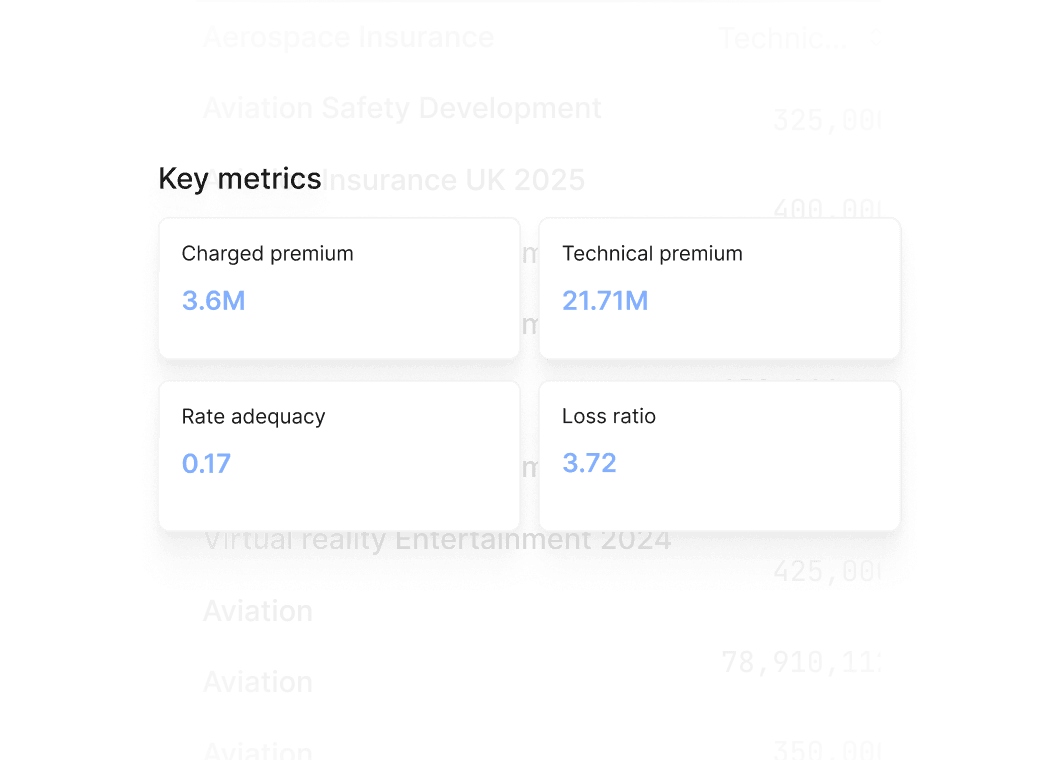

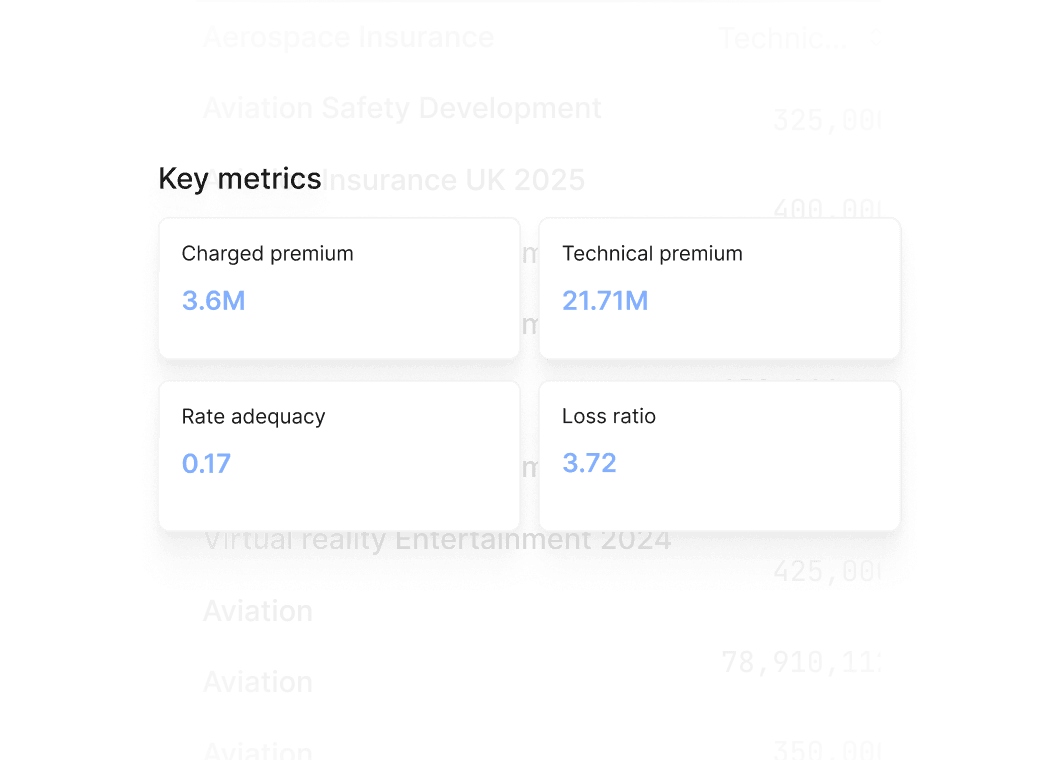

Deliver consistent, automated reporting on premium growth, rate adequacy and risk-adjusted rate change. Build trust with carriers and reinsurers through transparent, auditable data—unlocking better terms and long-term partnerships.

Win and retain carrier capacity.

Deliver consistent, automated reporting on premium growth, rate adequacy and risk-adjusted rate change. Build trust with carriers and reinsurers through transparent, auditable data—unlocking better terms and long-term partnerships.

Go to market faster.

Update pricing models and deploy changes instantly—respond to broker needs, launch new products, and win business with agility that outpaces the competition.

Go to market faster.

Update pricing models and deploy changes instantly—respond to broker needs, launch new products, and win business with agility that outpaces the competition.

How high-growth MGAs use hx

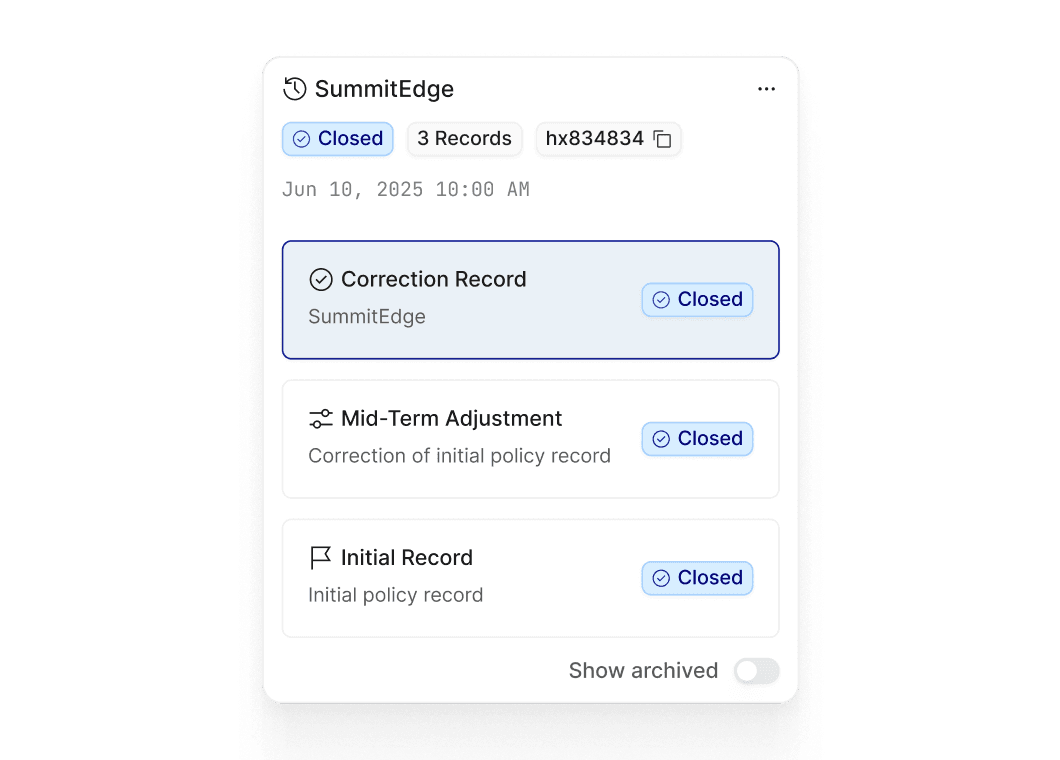

Triage

Turn around complex submissions in minutes and automate triage and prioritization, guided by your strategy and models.

Pricing & Rating

Deliver precise, explainable prices in seconds so underwriters quote faster and stay aligned to actuarial strategy.

Portfolio Intelligence

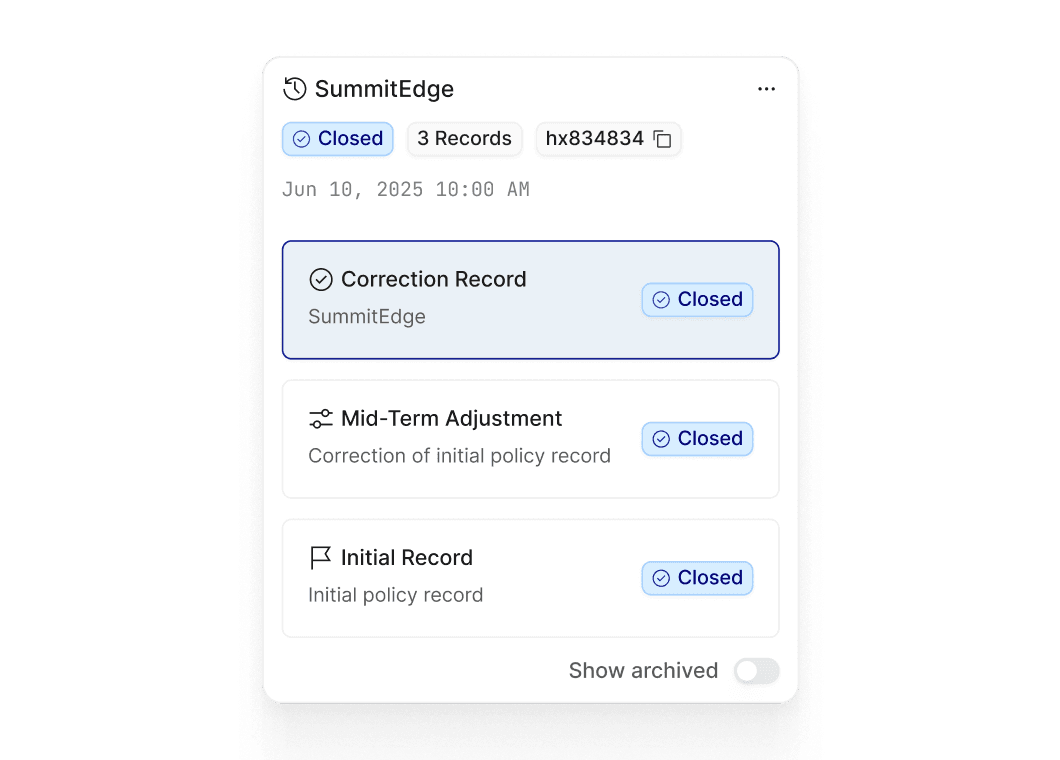

Get real-time portfolio performance and batch rating insights, backed by a complete record of every pricing decision and outcome.

Decision Engine

Create and govern adaptable decision logic with clear controls, safe changes, and confident releases.

How high-growth MGAs use hx

Triage

Turn around complex submissions in minutes and automate triage and prioritization, guided by your strategy and models.

Pricing & Rating

Deliver precise, explainable prices in seconds so underwriters quote faster and stay aligned to actuarial strategy.

Portfolio Intelligence

Get real-time portfolio performance and batch rating insights, backed by a complete record of every pricing decision and outcome.

Decision Engine

Create and govern adaptable decision logic with clear controls, safe changes, and confident releases.

Transforming pricing and underwriting workflows for MGAs

Legacy workflows

→

hx platform

Submission intake is ad hoc via emails and spreadsheets; underwriters must key data before pricing, slowing quotes and responses to brokers.

→

AI-powered ingestion automatically uploads submissions and generates a technical price before an underwriter touches the model, cutting response times and driving improved broker engagement.

Disjointed systems force manual rekeying between PAS and pricing tools; admin ballooning as you grow drags underwriter productivity down.

→

Seamless integration eliminates rekeying between PAS and pricing workbenches, freeing underwriters to focus on decisions and accelerating quote turnaround times.

Carrier reporting is manual and inconsistent; meeting multi-carrier requirements is painful, weakening trust and risking access to capacity.

→

Consistent, automated reporting on bound policies, rate adequacy and risk‑adjusted rate change builds transparency, strengthens carrier confidence, and unlocks better terms.

Model changes are slow—raters are hard to build and take months to deploy—so you miss broker needs and delay product launches.

→

Rapidly update pricing models and deploy quickly to respond to brokers and launch products faster, helping you win business with agility.

Limited portfolio visibility makes it hard to monitor rate change, accumulations, and projected loss ratios, hampering proactive steering and profitability.

→

Real‑time views of rate adjustments, accumulations, and projected loss ratios enable proactive, profitable portfolio management across lines and programs.

Transforming pricing and underwriting workflows for MGAs

Legacy workflows

hx platform

Submission intake is ad hoc via emails and spreadsheets; underwriters must key data before pricing, slowing quotes and responses to brokers.

AI-powered ingestion automatically uploads submissions and generates a technical price before an underwriter touches the model, cutting response times and driving improved broker engagement.

Disjointed systems force manual rekeying between PAS and pricing tools; admin ballooning as you grow drags underwriter productivity down.

Seamless integration eliminates rekeying between PAS and pricing workbenches, freeing underwriters to focus on decisions and accelerating quote turnaround times.

Carrier reporting is manual and inconsistent; meeting multi-carrier requirements is painful, weakening trust and risking access to capacity.

Consistent, automated reporting on bound policies, rate adequacy and risk‑adjusted rate change builds transparency, strengthens carrier confidence, and unlocks better terms.

Model changes are slow—raters are hard to build and take months to deploy—so you miss broker needs and delay product launches.

Rapidly update pricing models and deploy quickly to respond to brokers and launch products faster, helping you win business with agility.

Limited portfolio visibility makes it hard to monitor rate change, accumulations, and projected loss ratios, hampering proactive steering and profitability.

Real‑time views of rate adjustments, accumulations, and projected loss ratios enable proactive, profitable portfolio management across lines and programs.

Everything you need to win in the MGA market

Data integrations

Enrich risk assessment and improve pricing accuracy by integrating third-party data sources via robust API connections.

Data integrations

Enrich risk assessment and improve pricing accuracy by integrating third-party data sources via robust API connections.

Technology

Seamlessly connect to your pricing and underwriting tech stack, from policy admin systems to data warehouses and more.

Technology

Seamlessly connect to your pricing and underwriting tech stack, from policy admin systems to data warehouses and more.

Consulting

Leverage our network of trusted consulting partners with deep vertical expertise in successful transformation for insurers, carriers and MGAs.

Consulting

Leverage our network of trusted consulting partners with deep vertical expertise in successful transformation for insurers, carriers and MGAs.

Powering performance for MGAs

3-6% loss ratio improvement

Customers unlock portfolio-level analytics and rapid model development to drive loss ratio improvements

40% reduction in underwriter admin

Free underwriters from manual admin and rekeying to focus on high value risk assessment

10x faster model build

Specialty carriers using hx build and deploy new pricing tools 10x faster than legacy solutions

Accelerate your journey

from submission to decision

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018