Build robust tools to track, manage and price complex contracts in one place. Level-up portfolio analysis to manage volatility and improve the profitability of your book.

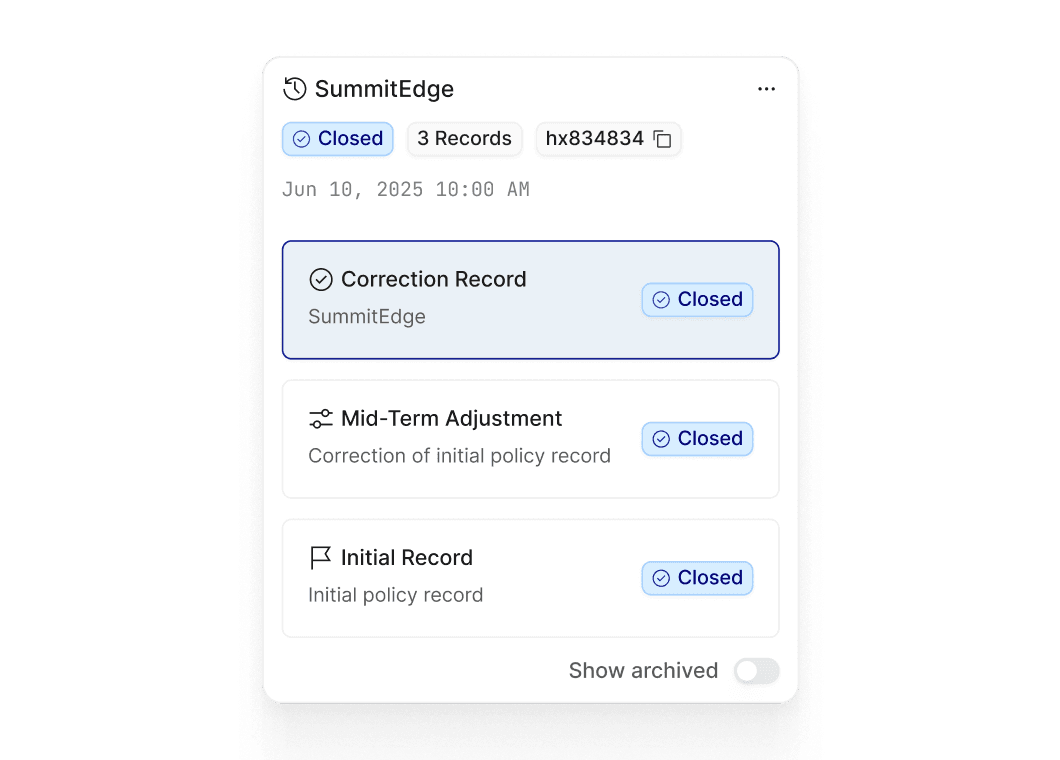

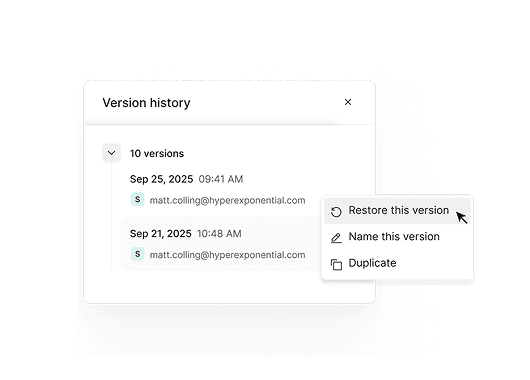

Maintain robust pricing tools without governance headaches

Replicate and enhance your existing models in a secure, web-based environment. Gain full control over assumptions, versioning, and audit trails - ensuring compliance and transparency at every step.

Streamline complex submission-to-quote workflows

Eliminate manual data preparation and streamline complex submission workflows - especially during peak renewal cycles - so you can focus on high value analysis, not admin.

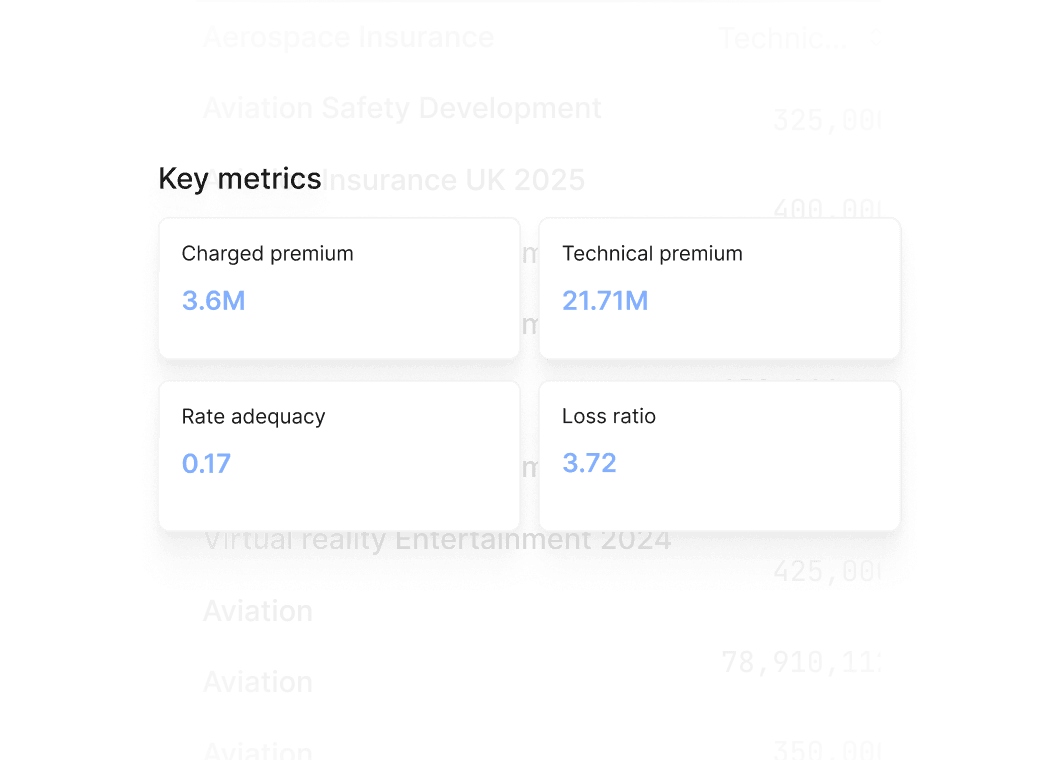

Make every decision portfolio and tail-risk aware

Aggregate results across all lines of business, run complex what-if analyses, and benchmark deals against your portfolio at the point of pricing - empowering smarter, more profitable decisions.

Everything you need to win in the Reinsurance market

Technology

Seamlessly connect your pricing & underwriting tech stack, from CAT modelling, exposure management systems and more.

Partnership

Reinsurance models demand technical depth. We work alongside your team to build pricing that handles complex treaty structures and your specific requirements.

Consulting

Leverage our network of trusted consulting partners with deep vertical expertise in successful transformation for Reinsurers.

Powering performance for reinsurers

3-6% loss ratio improvement

Customers unlock portfolio-level analytics and rapid model development to drive loss ratio improvements

40% reduction in underwriter admin

Free underwriters from manual admin and rekeying to focus on high value risk assessment

10x faster model build

Specialty carriers using hx build and deploy new pricing tools 10x faster than legacy solutions