The underwriting decision platform for Specialty & Commercial insurance

Transform your commercial and specialty insurance pricing and underwriting with a platform purpose-built for complex risk. Drive profitable growth with rapid model development, seamless collaboration, and portfolio-level insight.

Ship pricing tools 10x faster

Accelerate model development and deployment with a Python-based IDE, AI-powered co-pilot, and reusable components. Enable actuaries to build, iterate, and launch pricing tools in a fraction of the time.

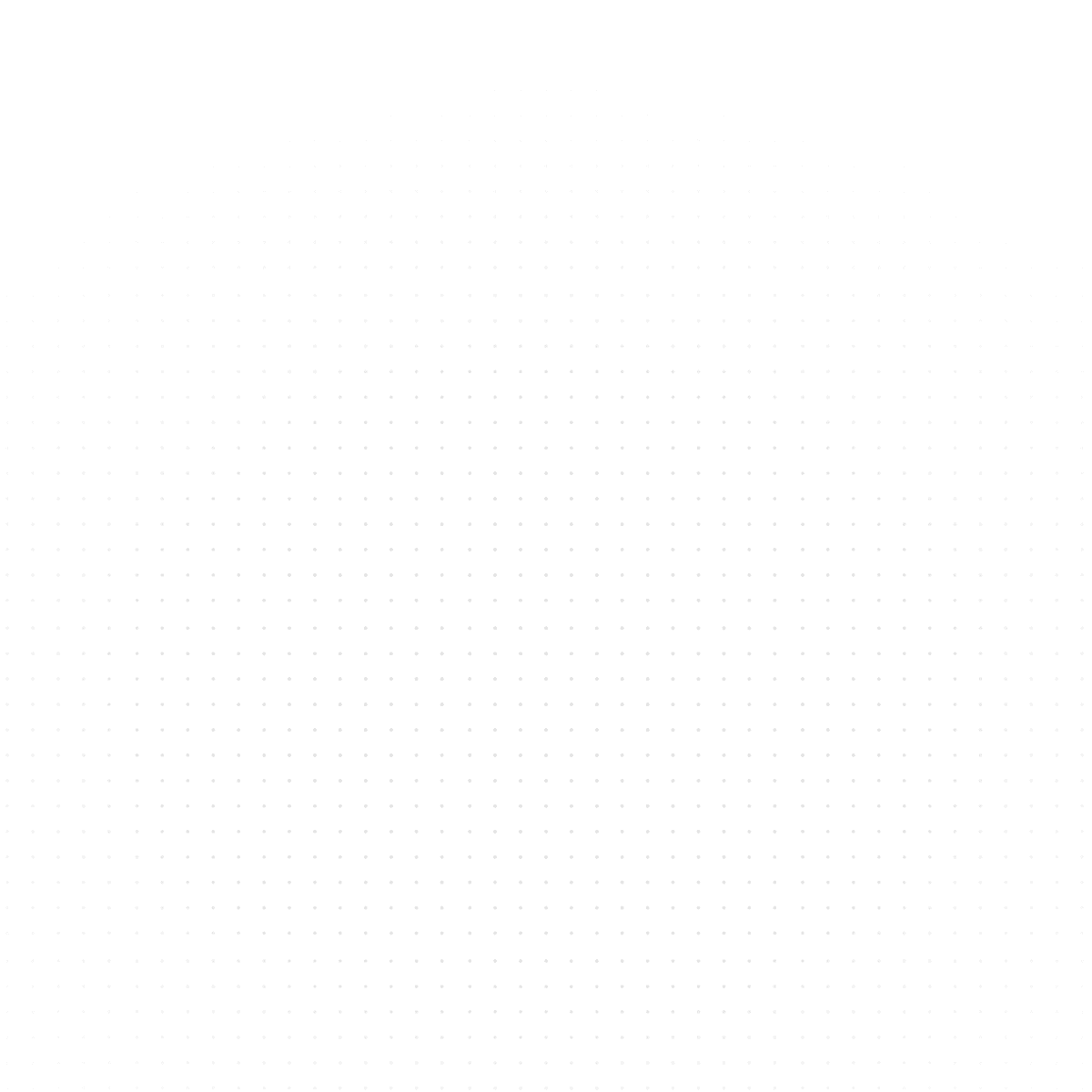

Unlock portfolio-level analysis

Automatically capture pricing data to run batch rating and portfolio analysis in minutes, giving underwriters and actuaries visibility into performance and the ability to make decisions with confidence.

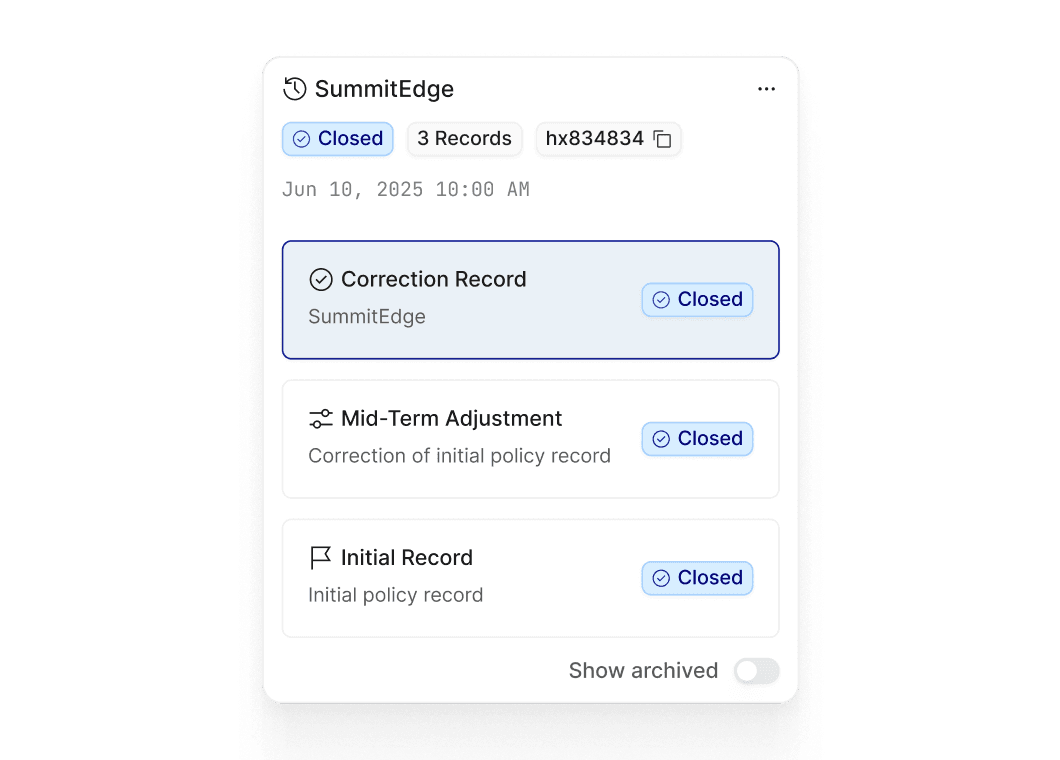

Control consistency and quality

Ensure robust governance with built-in model versioning, audit trails, automated regression checks, and embedded peer review—reducing risk of non-compliance and improving pricing accuracy.

Everything you need to win in the Specialty & Commercial market

Data integrations

Enrich risk assessment and improve pricing accuracy by integrating third-party data sources via robust API connections.

Technology

Seamlessly connect to your pricing and underwriting tech stack, from policy admin systems to data warehouses and more.

Consulting

Leverage our network of trusted consulting partners with deep vertical expertise in successful transformation for insurers, carriers and MGAs.

Powering performance for S&C carriers

3-6% loss ratio improvement

Customers unlock portfolio-level analytics and rapid model development to drive loss ratio improvements

40% reduction in underwriter admin

Free underwriters from manual admin and rekeying to focus on high value risk assessment

10x faster model build

Specialty carriers using hx build and deploy new pricing tools 10x faster than legacy solutions