The #1 pricing and underwriting platform for commercial P&C insurance.

Write a more

profitable book

Write a more

profitable book

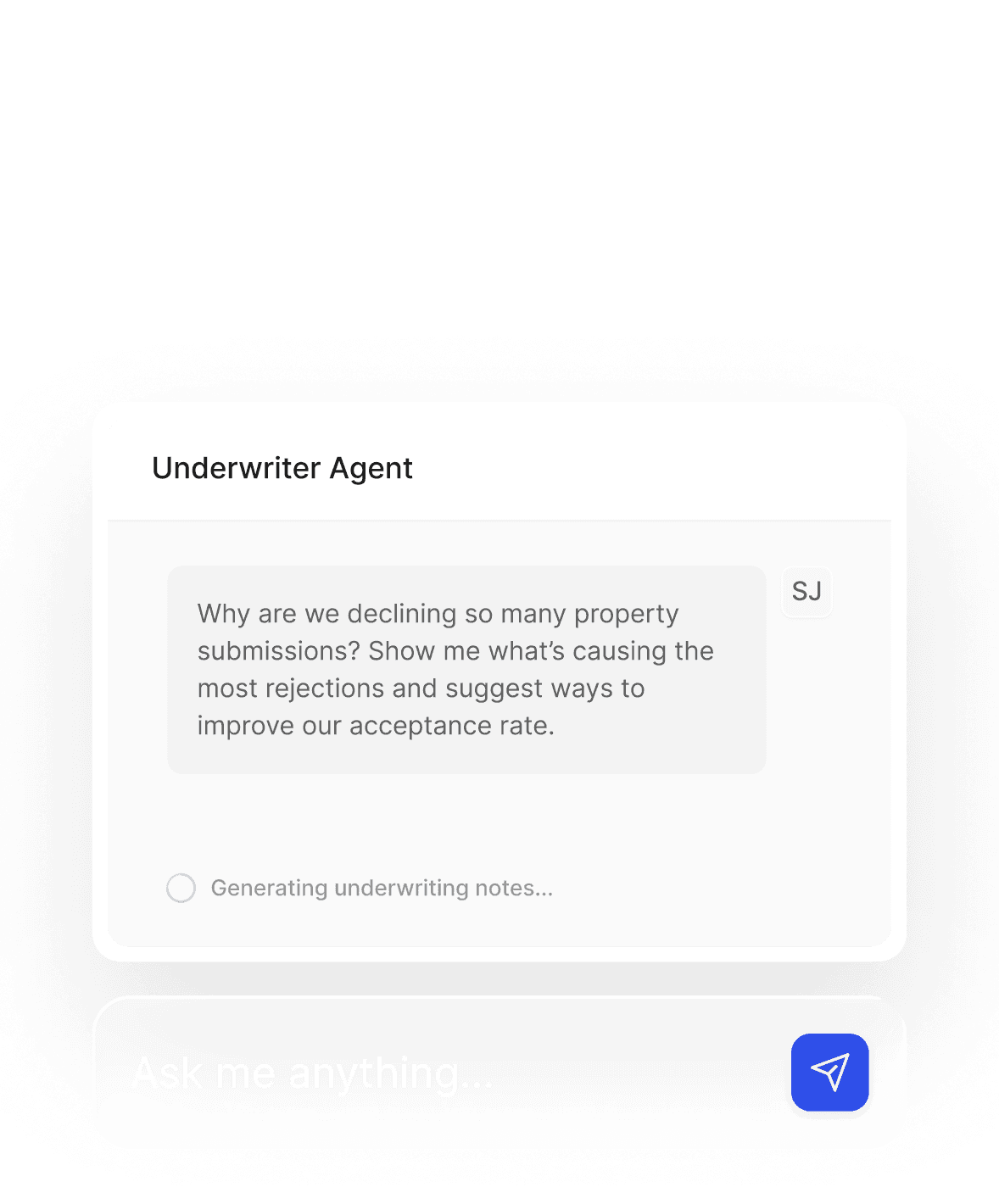

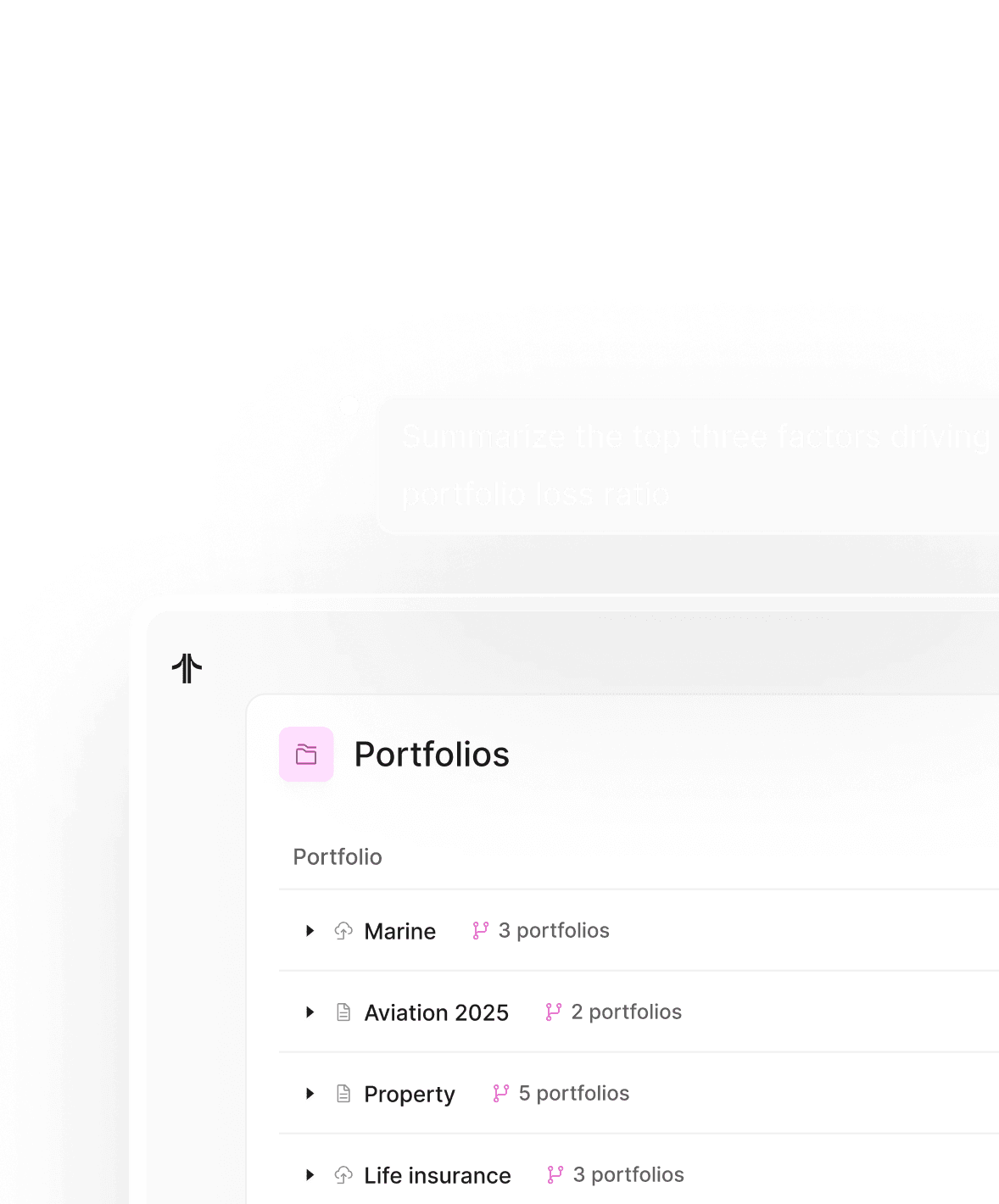

AI-assisted decisions from triage, to pricing, to portfolio optimization

Traditional workbenches organize tasks

hx powers underwriting performance

Strengthen decisions from triage to risk selection, pricing, and portfolio optimization with the most proven AI-native platform for commercial P&C.

Connect your data, encode your logic, and keep the full underwriting context all in one place, so your edge keeps sharpening over time.

Enterprise Security

SOC2 Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Enterprise Security

SOC2 Type 2 and ISO 27001:2022 certified, with rigorous controls to protect sensitive underwriting data and help you meet enterprise compliance requirements.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Full audit trails & governance

Every decision, rule change, and model update is captured end-to-end - giving you transparency, accountability, and a clear path for regulatory review.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

Open, portable, yours

Structured access to all data, configuration, and code, available anytime for full transparency, portability, and operational continuity.

Leading insurers prefer hx

$60bn

GWP contracted on the hx platform annually

2-3% loss ratio improvement

10x faster model build

50% faster quote to bind

58

models built in

nine months

Richer data capture for decision making

Seamless data integrations

Improved actuary-underwriter collaboration

75%

drop in model

build time

Aviva fast tracks model deployment with hx

Built 20 different pricing models in just 9-months

New policy creation cut to 5-10 minutes from 1hr

Heading goes here

$60bn

GWP contracted on the hx platform annually

2-3% loss ratio improvement

10x faster model build

50% faster quote to bind

58

models built in

nine months

Richer data capture for decision making

Seamless data integrations

Improved actuary-underwriter collaboration

75%

drop in model

build time

Aviva fast tracks model deployment with hx

Built 20 different pricing models in just 9-months

New policy creation cut to 5-10 minutes from 1hr

Leading insurers prefer hx

$60bn

GWP contracted on the hx platform annually

2-3% loss ratio improvement

10x faster model build

50% faster quote to bind

58

models built in

nine months

Richer data capture for decision making

Seamless data integrations

Improved actuary-underwriter collaboration

75%

drop in model

build time

Aviva fast tracks model deployment with hx

Built 20 different pricing models in just 9-months

New policy creation cut to 5-10 minutes from 1hr

Leading insurers prefer hx

$60bn

GWP contracted on the hx platform annually

2-3% loss ratio improvement

10x faster model build

50% faster quote to bind

58

models built in

nine months

Richer data capture for decision making

Seamless data integrations

Improved actuary-underwriter collaboration

75%

drop in model

build time

Aviva fast tracks model deployment with hx

Built 20 different pricing models in just 9-months

New policy creation cut to 5-10 minutes from 1hr

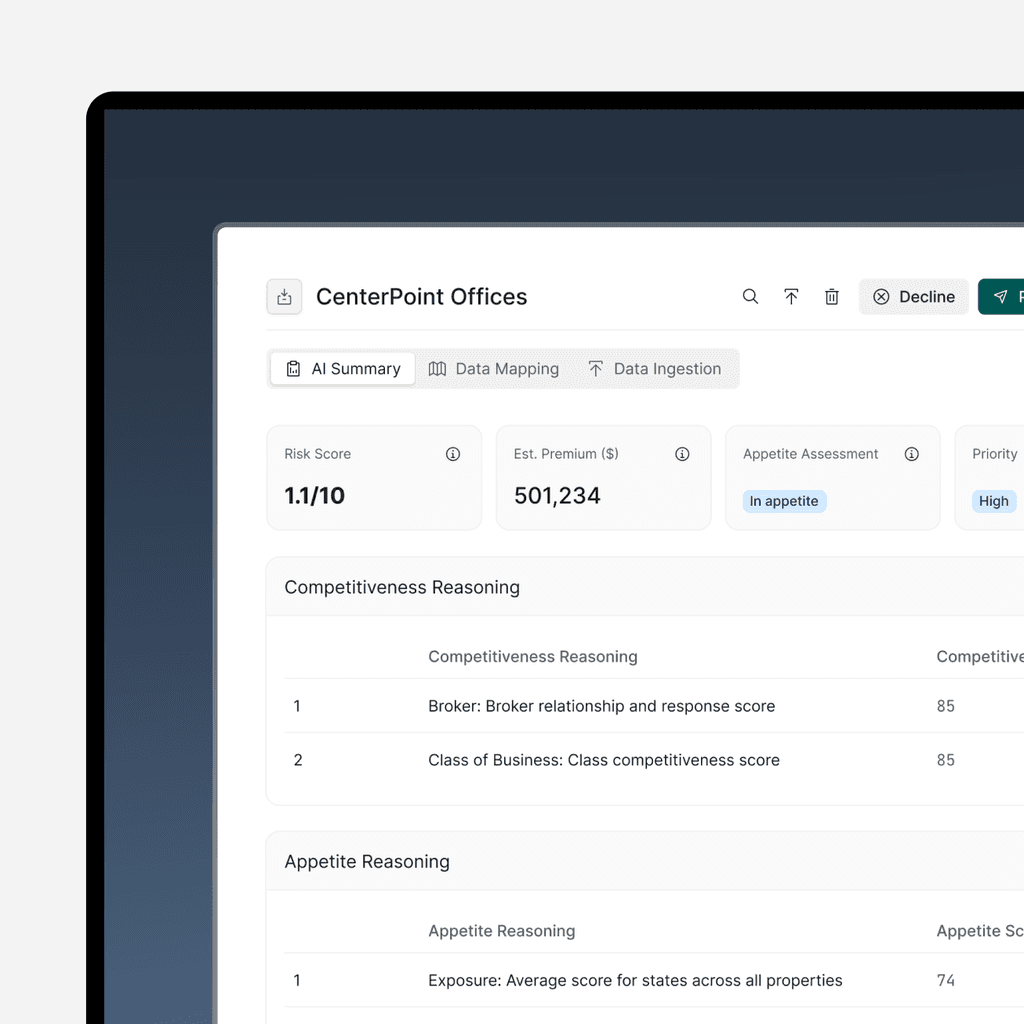

Solutions tailored for every role

Win better risks in half

the time

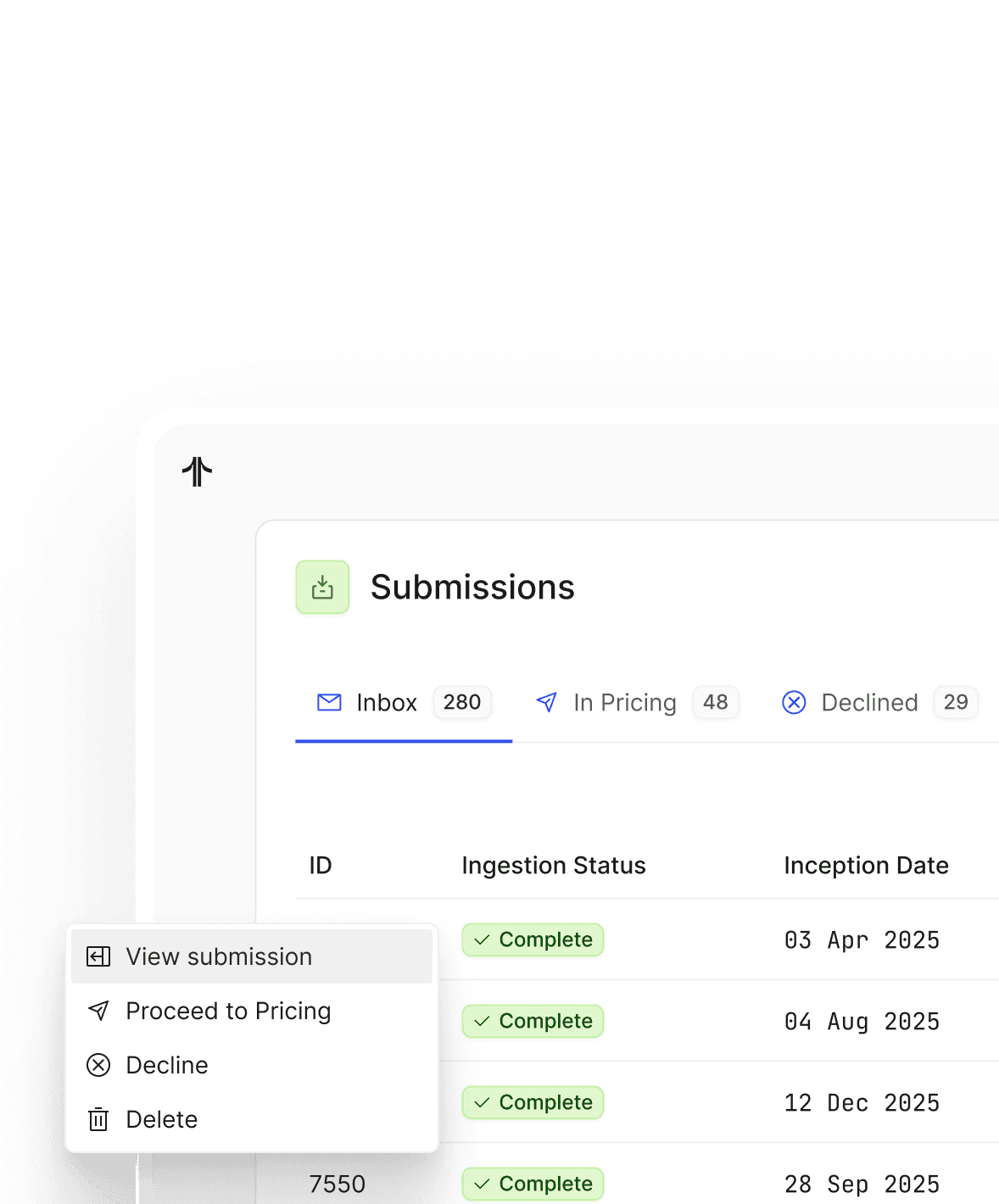

Manual underwriting keeps you buried in submission details when you should be focused on strategic risks, broker relationships, and portfolio optimization.

hx automates the mundane work and accelerates decisioning so you can quote faster, price smarter, and compete from a position of strength.

Underwriters

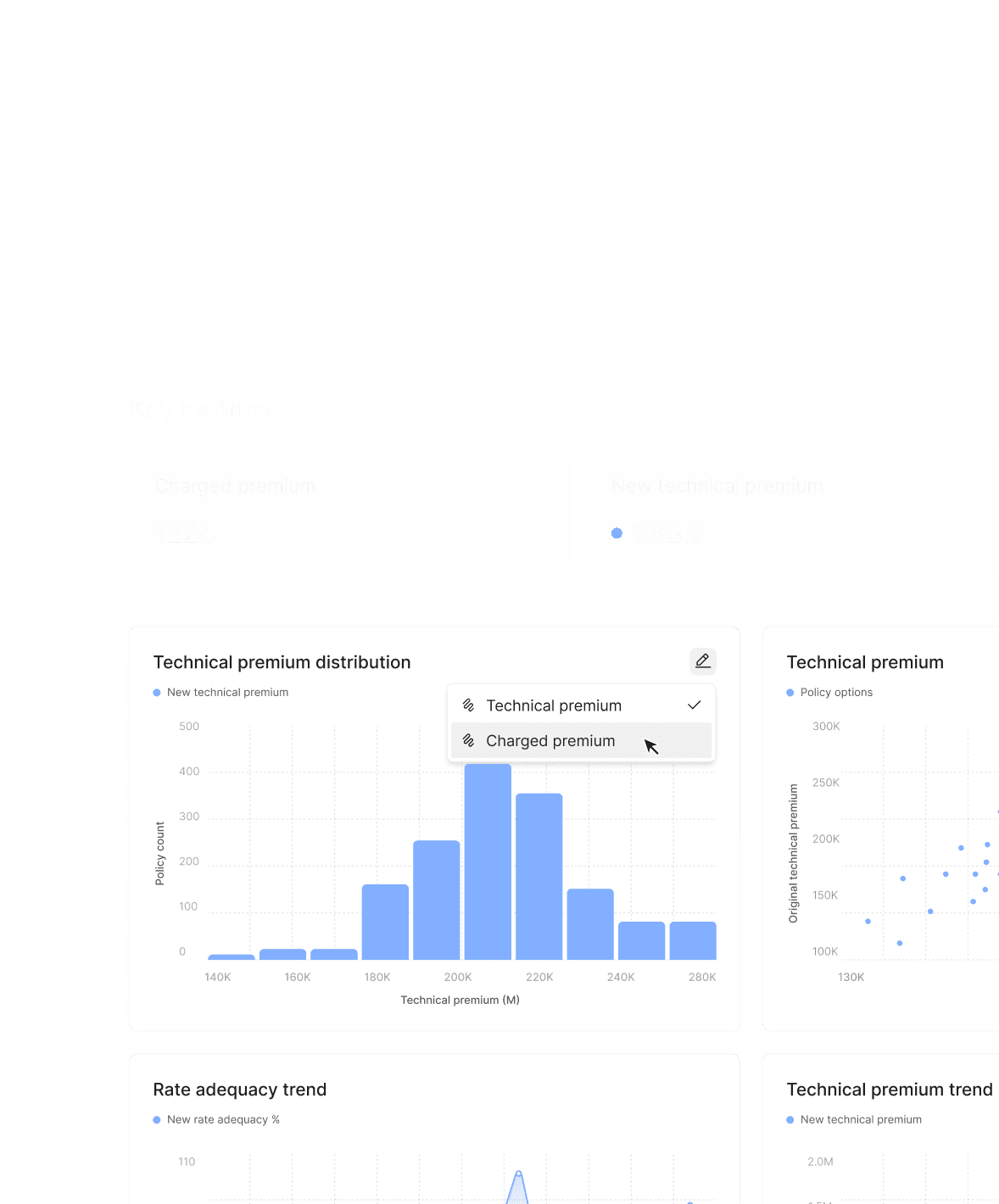

Build and deploy models 10x faster

Actuaries should be driving strategy, not wrestling with spreadsheets. hx lets you build sophisticated pricing models in minutes, deploy them to underwriters instantly, and focus on innovation that moves the business forward.

Actuaries

Win better risks in half

the time.

Eliminate tedious data entry.

Technology

"By partnering with hx, we're making intelligent underwriting a reality for our Global Corporate & Specialty business"

Karen Dayal

Chief Underwriting Officer, Aviva

"By partnering with hx, we're making intelligent underwriting a reality for our Global Corporate & Specialty business"

Karen Dayal

Chief Underwriting Officer, Aviva

"By partnering with hx, we're making intelligent underwriting a reality for our Global Corporate & Specialty business"

Karen Dayal

Chief Underwriting Officer, Aviva

Featured resources

Accelerate your journey

from submission to decision

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018

© 2025 hyperexponential

QMS Certificate No. 306072018